Understanding inflation rates dives into the complex world of economic indicators, shedding light on how these rates shape our financial landscape. From calculating inflation to its effects on consumers and businesses, this topic is a crucial aspect of understanding the economy’s health and stability.

Definition of Inflation Rates

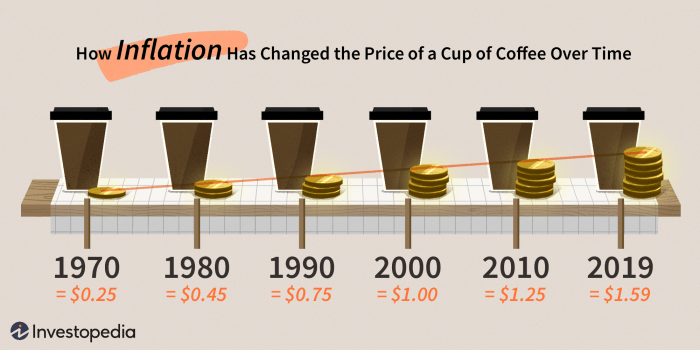

Inflation rates refer to the percentage increase in the general price level of goods and services over a period of time. These rates are typically calculated using a price index, such as the Consumer Price Index (CPI), which tracks changes in the prices of a basket of goods commonly purchased by households.

Examples of Impact on the Economy

- Inflation rates can erode the purchasing power of consumers, leading to a decrease in real wages and disposable income.

- Businesses may face higher production costs as input prices rise, potentially impacting profit margins.

- Central banks use inflation rates as a key indicator to set monetary policy, such as adjusting interest rates to control inflation.

Significance of Measuring Inflation Rates Accurately

Accurately measuring inflation rates is crucial for policymakers, businesses, and consumers to make informed decisions. A precise understanding of inflation rates helps in predicting future price movements, adjusting wages and prices, and maintaining overall economic stability. By monitoring inflation rates accurately, stakeholders can respond effectively to economic challenges and opportunities.

Types of Inflation

Inflation can manifest in various forms, each with distinct causes and effects that impact the economy differently.

Demand-Pull Inflation

Demand-pull inflation occurs when the demand for goods and services surpasses the economy’s ability to produce them. This leads to an increase in prices due to the imbalance between supply and demand. As a result, consumers experience higher costs, leading to a decrease in purchasing power. An example of demand-pull inflation is the post-World War II economic boom in the United States, where increased consumer demand outpaced production capacity, causing prices to rise.

Cost-Push Inflation

Cost-push inflation is driven by an increase in production costs, such as rising wages or raw material prices, leading to higher prices for consumers. This type of inflation can be detrimental to businesses as they face reduced profit margins. An example of cost-push inflation can be seen during the 1970s oil crisis when oil prices surged, causing a ripple effect across various industries and leading to an overall increase in prices.

Built-In Inflation, Understanding inflation rates

Built-in inflation, also known as wage-price spiral, occurs when workers demand higher wages to keep up with rising prices, leading to a continuous cycle of wage and price increases. This self-perpetuating cycle can be challenging to break, as rising prices necessitate higher wages, further fueling inflation. An example of built-in inflation is the stagflation period in the 1970s, where the combination of high inflation and stagnant economic growth created a challenging economic environment.

Factors Influencing Inflation Rates: Understanding Inflation Rates

Inflation rates are influenced by a variety of factors that can impact the overall economy and purchasing power. Understanding these factors is crucial in predicting and managing inflation rates effectively.

Monetary Policy Decisions

Monetary policy decisions made by central banks play a significant role in influencing inflation rates. By adjusting interest rates, controlling the money supply, and implementing other monetary policies, central banks can directly impact inflation levels. For example, lowering interest rates can stimulate spending and borrowing, leading to an increase in inflation, while raising interest rates can have the opposite effect.

Economic Indicators: GDP and Unemployment

The relationship between inflation rates and economic indicators like Gross Domestic Product (GDP) and unemployment is crucial in understanding the overall health of an economy. A growing GDP can often lead to higher inflation rates as demand for goods and services increases. Conversely, high levels of unemployment can lead to lower inflation rates as consumer spending decreases. Monitoring these economic indicators can provide insights into potential inflation trends and help policymakers make informed decisions.

Effects of Inflation Rates on Consumers and Businesses

Inflation rates can have significant impacts on both consumers and businesses, influencing their purchasing power and operational decisions.

Impact on Consumers

High inflation rates can erode the purchasing power of consumers, meaning that their money buys less than it used to. This can lead to a decrease in the standard of living as prices rise faster than wages.

- Consumers may need to budget more carefully and prioritize essential purchases over discretionary spending.

- Investing in assets that appreciate with inflation, such as real estate or stocks, can help protect wealth.

- Utilizing inflation-indexed securities like Treasury Inflation-Protected Securities (TIPS) can provide a hedge against rising prices.

Impact on Businesses

Businesses must also adapt to changing inflation rates to remain competitive and profitable.

- Cost-push inflation can increase production costs, forcing businesses to raise prices or find ways to reduce expenses.

- Demand-pull inflation may result in increased sales but require businesses to expand capacity to meet growing demand.

- Adjusting pricing strategies, renegotiating contracts with suppliers, and diversifying product offerings are common tactics used by businesses to navigate inflationary environments.