Buckle up, because we’re about to dive into the world of Types of life insurance. Get ready for a rollercoaster ride of information that will leave you informed and intrigued.

In this guide, we’ll break down the different types of life insurance policies and help you navigate through the complexities of each.

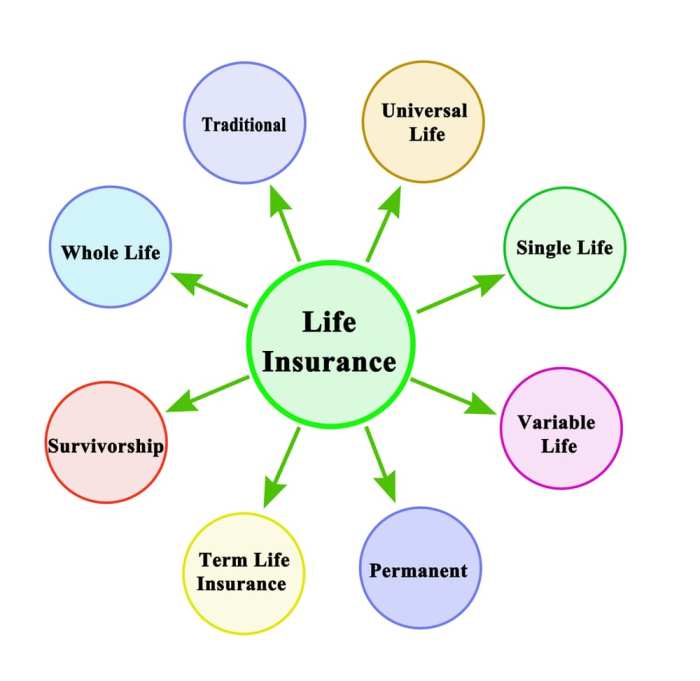

Types of Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, usually 10, 20, or 30 years. If the insured passes away during the term, their beneficiaries receive the death benefit. This type of insurance does not have a cash value component and is typically more affordable than other types of life insurance.

Whole Life Insurance

Whole life insurance provides coverage for the entire life of the insured, as long as premiums are paid. It also includes a cash value component that grows over time and can be borrowed against or withdrawn. Premiums are usually higher than term life insurance but remain level throughout the life of the policy.

Universal Life Insurance

Universal life insurance offers flexibility in premium payments and death benefits. Policyholders can adjust their premiums and coverage amounts to suit their changing needs. The policy’s cash value grows at a specified interest rate, which is usually guaranteed not to fall below a certain level.

Variable Life Insurance

Variable life insurance allows policyholders to allocate their premiums among various investment options, such as stocks, bonds, or mutual funds. The cash value and death benefit can fluctuate based on the performance of these investments. This type of insurance carries more risk but also offers the potential for higher returns compared to other types of life insurance.

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to the beneficiaries if the insured individual passes away during the term of the policy.

Coverage Duration Options

Term life insurance policies typically offer coverage durations of 10, 15, 20, 25, or 30 years. The policyholder selects the term length based on their financial needs and the period during which they need coverage. Shorter terms may have lower premiums, while longer terms provide coverage for a more extended period.

Flexibility of Premium Payments

Premium payments for term life insurance are fixed for the duration of the policy term. Policyholders have the flexibility to choose monthly, quarterly, semi-annual, or annual premium payment schedules based on their preferences and budget. It allows for easier budgeting and planning for the policyholder.

Renewal Options

At the end of the initial term, many term life insurance policies offer the option to renew the coverage. However, the premium rates for renewal are typically higher and are based on the policyholder’s age and health at the time of renewal. Some policies may also allow for conversion to a permanent life insurance policy without the need for a medical exam.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured as long as premiums are paid. Unlike term life insurance, which only covers a specific period, whole life insurance offers both a death benefit and a cash value component that grows over time.

Characteristics of Whole Life Insurance Policies:

- Guaranteed Death Benefit: Whole life insurance guarantees a death benefit payout to the beneficiaries upon the death of the insured.

- Cash Value Accumulation: A portion of the premiums paid goes towards a cash value account that grows over time and can be accessed through withdrawals or policy loans.

- Premiums: Premiums for whole life insurance are typically higher than term life insurance but remain level throughout the life of the policy.

Examples of Cash Value Accumulation in Whole Life Insurance:

- Policy Dividends: Some whole life insurance policies pay out dividends based on the insurer’s financial performance, which can be used to purchase additional coverage or increase the cash value.

- Interest Growth: The cash value in a whole life insurance policy grows over time with interest, providing a source of savings that can be tapped into during the insured’s lifetime.

Loan Options Available with Whole Life Insurance:

- Policy Loans: Policyholders can borrow against the cash value of their whole life insurance policy at a relatively low interest rate, with the policy serving as collateral.

- Flexible Repayment: Policy loans do not require a credit check and offer flexible repayment options, allowing policyholders to repay the loan on their own terms.

Potential Tax Advantages of Whole Life Insurance:

- Tax-Deferred Growth: The cash value in a whole life insurance policy grows tax-deferred, meaning policyholders do not have to pay taxes on the growth until they withdraw the funds.

- Tax-Free Death Benefit: The death benefit paid out to beneficiaries is generally income tax-free, providing financial security to loved ones without additional tax burdens.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers both a death benefit and a savings component. This policy provides flexibility in premium payments and death benefits, making it a popular choice for many individuals.

Key Features of Universal Life Insurance

Universal life insurance allows policyholders to adjust their premium payments and death benefits based on their financial situation. This flexibility provides the opportunity to increase or decrease coverage as needed.

- Policyholders can access the cash value of their universal life insurance policy through loans or withdrawals.

- Universal life insurance offers the potential for cash value growth over time, depending on the performance of the underlying investments.

- These policies typically have a minimum interest rate guarantee, ensuring that the cash value will not decrease below a certain level.

Flexibility in Premium Payments and Death Benefits

Universal life insurance allows policyholders to change the amount and frequency of premium payments, as well as the death benefit amount. This flexibility can help individuals adapt to changing financial circumstances throughout their lives.

Policyholders can increase their premium payments to build cash value faster or decrease payments during times of financial strain.

Investment Component of Universal Life Insurance

Universal life insurance policies include a savings component that allows policyholders to allocate cash value into investment accounts. These accounts can include options such as stocks, bonds, or money market funds, providing the potential for greater returns compared to traditional whole life insurance policies.

Policyholders can choose how to invest their cash value, giving them more control over the growth of their policy.

Pros and Cons of Universal Life Insurance

When compared to other types of life insurance, universal life insurance offers greater flexibility and potential for cash value growth. However, it also comes with higher fees and administrative costs, which can impact the overall returns on the policy.

- Pros:

- Flexibility in premium payments and death benefits.

- Potential for cash value growth through investments.

- Ability to adjust coverage as financial needs change.

- Cons:

- Higher fees and administrative costs.

- Dependence on investment performance for cash value growth.

- Complexity in understanding policy features and benefits.

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that offers a death benefit and a cash value component that can be invested in various options such as stocks, bonds, and mutual funds. Unlike other types of life insurance, the cash value in variable life insurance is not guaranteed and fluctuates based on the performance of the investments chosen by the policyholder.

Investment Options in Variable Life Insurance

- Policyholders can choose from a variety of investment options such as equity funds, fixed-income funds, and money market funds.

- The policyholder has the flexibility to allocate premiums among different investment options based on their risk tolerance and financial goals.

- The performance of the investments directly affects the cash value of the policy and ultimately the death benefit paid out to beneficiaries.

Risks and Rewards of Variable Life Insurance

-

Risks:

The cash value of variable life insurance is subject to market fluctuations, which means it can decrease if the investments perform poorly.

-

Rewards:

If the investments perform well, the cash value and death benefit of the policy can increase significantly, providing potential for higher returns compared to other types of life insurance.

Role of Policyholder in Managing Investments

- The policyholder plays a crucial role in managing investments within variable life insurance by selecting the investment options, monitoring performance, and adjusting allocations as needed.

- It is important for the policyholder to regularly review the investment portfolio and make informed decisions to optimize the cash value and potential growth of the policy.