Kicking off with Risk tolerance assessment, this opening paragraph is designed to captivate and engage the readers, setting the tone american high school hip style that unfolds with each word.

When it comes to making smart investment decisions, understanding your risk tolerance is key. This assessment helps you tailor your investments to match your financial goals and diversify your portfolio effectively. Let’s dive into the world of risk tolerance assessment and explore its importance in the investment landscape.

Importance of Risk Tolerance Assessment

Risk tolerance assessment is a critical step in making informed investment decisions. By understanding an individual’s risk tolerance, investors can tailor their investment strategies to align with their financial goals and objectives. This assessment helps in determining the level of risk an individual is comfortable with, ultimately guiding them towards investments that match their risk appetite.

Aligning Investments with Financial Goals

Risk tolerance assessment plays a crucial role in ensuring that investments are in line with an individual’s financial goals. By determining how much risk an individual can tolerate, they can choose investments that offer an appropriate balance between risk and return. This alignment helps in achieving financial objectives while minimizing the potential for unexpected losses.

Impact on Portfolio Diversification

Understanding risk tolerance also has a significant impact on portfolio diversification. By knowing their risk tolerance level, investors can construct a well-diversified portfolio that spreads risk across different asset classes. This diversification helps in reducing overall portfolio risk and potentially enhancing returns over the long term.

Methods of Assessing Risk Tolerance

Assessing risk tolerance is crucial in determining an individual’s comfort level with taking risks when it comes to investments. There are various methods used to assess risk tolerance, each with its own strengths and weaknesses.

Quantitative vs. Qualitative Approaches

When it comes to assessing risk tolerance, both quantitative and qualitative approaches are commonly used. Quantitative methods involve numerical calculations and statistical analysis to determine risk tolerance levels. This may include looking at factors such as age, income, investment goals, and past investment experiences to come up with a risk profile.

On the other hand, qualitative approaches rely on more subjective assessments, such as questionnaires, interviews, and discussions to gauge an individual’s risk tolerance. These methods focus on understanding an individual’s feelings, attitudes, and beliefs towards risk, rather than just numbers and data.

While quantitative approaches provide a more objective measure of risk tolerance, qualitative methods offer a deeper insight into an individual’s psychological relationship with risk. Combining both approaches can provide a more comprehensive understanding of an individual’s risk tolerance.

Risk Tolerance Questionnaires

Risk tolerance questionnaires are commonly used in the industry to assess an individual’s risk tolerance. These questionnaires typically ask a series of questions related to an individual’s financial situation, investment goals, time horizon, and risk preferences. Based on the responses, an individual is categorized into a risk profile that matches their risk tolerance level.

Examples of popular risk tolerance questionnaires include the Riskalyze questionnaire, FinaMetrica Risk Profiling questionnaire, and the Vanguard Investor Questionnaire. These questionnaires help financial advisors and investors alike to better understand how much risk an individual is willing to take on in their investment portfolio.

Factors Influencing Risk Tolerance

When it comes to risk tolerance, there are several key factors that can influence an individual’s comfort level with taking risks in their investments. These factors play a crucial role in determining how much risk an individual is willing to take on.

Age, financial goals, and investment experience are three major factors that can impact an individual’s risk tolerance. Let’s delve deeper into how each of these factors can shape one’s risk tolerance levels.

Age

Age plays a significant role in determining risk tolerance. Generally, younger individuals tend to have a higher risk tolerance compared to older individuals. This is because younger individuals have more time to recover from any losses they may incur in their investments. As individuals approach retirement age, they often become more risk-averse to protect their nest egg.

Financial Goals

Another crucial factor that influences risk tolerance is an individual’s financial goals. If someone has aggressive financial goals, such as early retirement or purchasing a second home, they may be more inclined to take on higher levels of risk in their investments. On the other hand, individuals with more conservative financial goals may prefer lower-risk investments to safeguard their capital.

Investment Experience

Investment experience also plays a vital role in shaping risk tolerance levels. Individuals with more experience in investing may feel more comfortable taking on higher levels of risk, as they understand the potential rewards and pitfalls of different investment options. Conversely, individuals with limited investment experience may prefer safer, more stable investment choices to minimize the risk of losing their hard-earned money.

Psychological Biases

Psychological biases can also heavily influence an individual’s risk tolerance. Cognitive biases such as loss aversion, overconfidence, and herding behavior can lead individuals to make irrational decisions when it comes to investing. These biases can either inflate or deflate one’s risk tolerance, impacting the overall investment strategy.

By considering these key factors, individuals can better understand their own risk tolerance and make informed decisions when it comes to investing their money.

Implications of Risk Tolerance Assessment Results

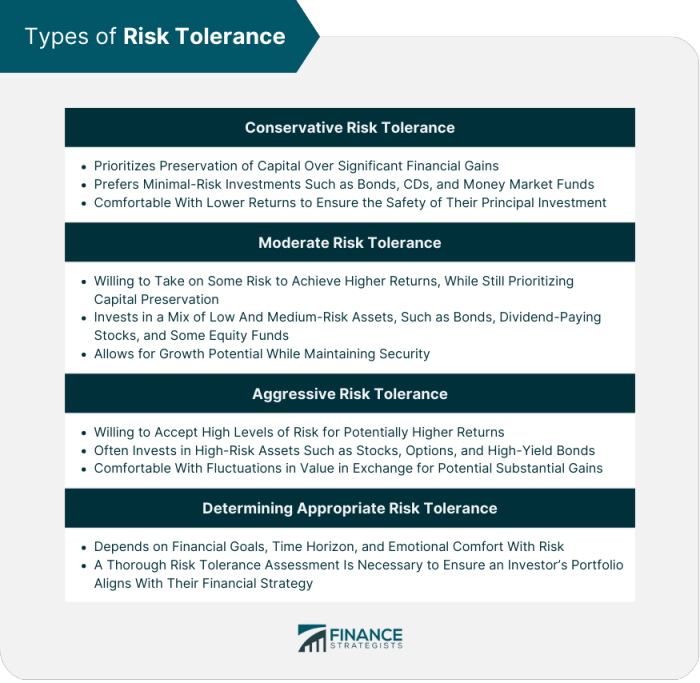

When it comes to asset allocation decisions, the results of a risk tolerance assessment play a crucial role in determining the investment mix that aligns with an individual’s risk profile. These results help investors understand the level of risk they are comfortable with, guiding them to choose investments that match their risk appetite.

Impact on Asset Allocation

- The risk tolerance assessment results can influence the percentage of assets allocated to different asset classes such as stocks, bonds, or cash equivalents.

- Investors with a higher risk tolerance may opt for a more aggressive asset allocation, with a larger portion allocated to equities for potentially higher returns.

- Conversely, those with a lower risk tolerance may prefer a more conservative allocation, focusing on fixed-income investments for greater stability.

Relationship with Investment Time Horizon

- Risk tolerance is closely linked to an individual’s investment time horizon, as it determines how long they can hold investments to ride out market fluctuations.

- Investors with a longer time horizon may be more willing to take on higher risks, as they have more time to recover from any potential losses.

- On the other hand, those with a shorter time horizon may need to prioritize capital preservation, leading to a more conservative investment approach.

Guiding Investment Strategies

- Based on risk tolerance assessment results, investors can tailor their investment strategies to align with their risk preferences and financial goals.

- For example, a conservative investor with a low risk tolerance may focus on building a diversified portfolio of low-risk assets to protect their principal.

- In contrast, an aggressive investor with a high risk tolerance may choose to concentrate on growth-oriented investments to pursue higher returns, accepting the possibility of greater volatility.