Dive into the world of investment research tools where knowledge is power and success is just a click away. From analyzing market trends to making informed decisions, these tools are the secret sauce to financial prosperity. Get ready to explore the ins and outs of investment research tools in this exciting journey of discovery.

Importance of Investment Research Tools

Investment research tools play a crucial role in helping investors make informed decisions about where to put their money. These tools provide valuable insights into market trends, company performance, and overall economic conditions, enabling investors to analyze data and make better investment choices.

Popular Investment Research Tools and Features

- Yahoo Finance: This platform offers a wide range of financial data, news, and analysis tools to help investors track market trends and make informed decisions.

- Morningstar: Known for its comprehensive research reports and ratings on various investment options, Morningstar helps investors evaluate the performance of mutual funds, stocks, and ETFs.

- Seeking Alpha: A popular platform for market news, analysis, and investment insights, Seeking Alpha provides a community-driven approach to investment research.

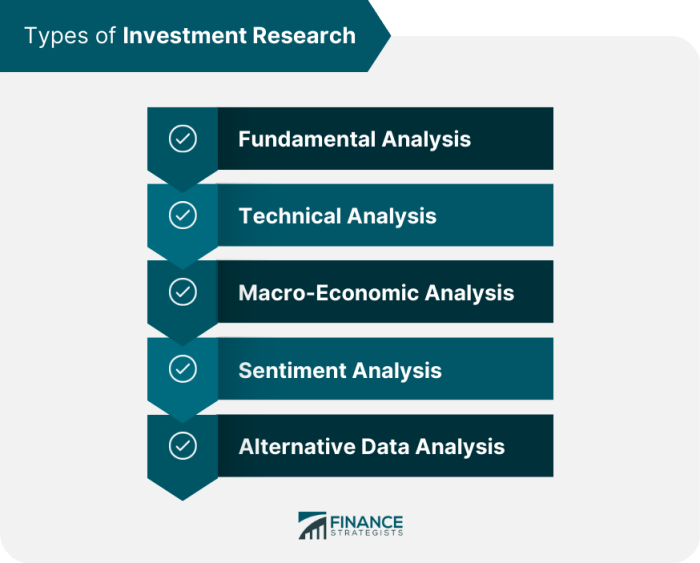

Types of Investment Research Tools

Investment research tools come in various categories, each serving a specific purpose to assist investors in making informed decisions. Let’s explore the different types of investment research tools and how they can benefit investors.

Stock Screeners

Stock screeners are tools that allow investors to filter stocks based on specific criteria such as market capitalization, price-to-earnings ratio, dividend yield, and more. By using stock screeners, investors can quickly identify potential investment opportunities that meet their criteria.

- Helps investors narrow down the vast universe of stocks to find those that align with their investment goals.

- Allows investors to set custom filters and parameters to screen for stocks that meet their specific requirements.

- Provides real-time data and alerts on stock performance, helping investors stay informed about market trends.

Financial Analysis Software

Financial analysis software is designed to help investors analyze financial data, evaluate company performance, and make data-driven investment decisions. These tools often include features such as financial statement analysis, ratio analysis, and forecasting capabilities.

- Enables investors to conduct in-depth financial analysis of companies to assess their financial health and growth potential.

- Offers tools for comparing financial metrics, identifying trends, and evaluating investment opportunities.

- Provides customizable reports and dashboards to present financial data in a clear and concise manner.

Portfolio Trackers

Portfolio trackers are tools that help investors monitor their investment portfolios, track performance, and make informed decisions about asset allocation and rebalancing. These tools typically offer features such as real-time portfolio tracking, performance analysis, and risk management tools.

- Allows investors to track the performance of their investments in real-time and make adjustments as needed.

- Provides insights into portfolio diversification, risk exposure, and asset allocation to help investors optimize their portfolios.

- Offers tools for setting investment goals, monitoring progress, and generating performance reports.

Features to Look for in Investment Research Tools

When choosing investment research tools, investors should consider key features that can significantly impact their research process. Features like real-time data, customizable alerts, and technical analysis tools play a crucial role in helping investors make informed decisions. Additionally, user-friendly interfaces and mobile compatibility are important aspects to ensure ease of use and accessibility.

Real-time Data

Real-time data is essential for investors as it provides up-to-the-minute information on market trends, stock prices, and news. This feature allows investors to stay current with market movements and make timely decisions based on the latest data available.

Customizable Alerts

Customizable alerts enable investors to set specific criteria for notifications based on their preferences. These alerts can notify investors of price changes, news updates, or any other significant events that may impact their investments. By customizing alerts, investors can stay informed without constantly monitoring the market.

Technical Analysis Tools

Technical analysis tools are crucial for investors who rely on charts, indicators, and patterns to analyze market trends and predict future price movements. These tools help investors identify potential entry and exit points, as well as assess the overall market sentiment. Having access to technical analysis tools can enhance the accuracy of investment decisions.

User-friendly Interfaces and Mobile Compatibility

User-friendly interfaces are important in investment research tools as they ensure a seamless and intuitive user experience. A well-designed interface makes it easier for investors to navigate through data, conduct research, and analyze information efficiently. Mobile compatibility is also essential, allowing investors to access research tools on-the-go, ensuring flexibility and convenience in managing investments.

How to Use Investment Research Tools Effectively

Investment research tools can be powerful resources for investors looking to make informed decisions and maximize their returns. By utilizing these tools effectively, investors can gain valuable insights into market trends, financial data, and investment opportunities. Here are some tips on how to make the most out of investment research tools:

Utilizing Multiple Tools for Comprehensive Analysis

When using investment research tools, it’s essential to leverage a combination of different tools to gain a comprehensive understanding of the market. By using tools such as stock screeners, financial news aggregators, and technical analysis platforms together, investors can identify trends, assess risk, and uncover potential investment opportunities.

Creating a Workflow for Different Investment Goals

It’s crucial to tailor your use of investment research tools to your specific investment goals. For example, if you’re a long-term investor looking for stable growth opportunities, you may focus on fundamental analysis tools like financial statement databases. On the other hand, if you’re a day trader looking to capitalize on short-term price movements, you might prioritize technical analysis tools like charting platforms and real-time market data feeds.

Examples of Successful Investment Research Tool Workflows

One effective workflow for value investors could involve using a combination of stock screeners to identify undervalued companies, financial statement analysis tools to assess their financial health, and news aggregators to stay informed about market developments. On the other hand, a momentum trader might rely on technical analysis tools like moving averages and volume indicators to identify trends and make quick trading decisions.