Beginning with Investment diversification, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Exploring the concept of investment diversification is crucial for optimizing financial portfolios and mitigating risks effectively. Diversifying investments across various assets is a fundamental strategy that offers stability and growth potential in dynamic market conditions.

Importance of Investment Diversification

Investment diversification is the strategy of spreading your investments across different asset classes, industries, and geographical regions to reduce risk and maximize returns. By diversifying your portfolio, you can protect yourself from the volatility of individual investments and market fluctuations.

Managing Risk

Diversifying investments is crucial for managing risk because it helps to mitigate the impact of any one investment performing poorly. For example, if you only invest in one company and that company experiences financial difficulties, your entire investment could be at risk. However, by diversifying across multiple companies, industries, and asset classes, the impact of one underperforming investment is minimized.

Benefits in Volatile Markets

In volatile markets, diversification can help stabilize your portfolio by offsetting losses in one asset class with gains in another. For instance, during a market downturn, bonds or real estate investments may perform better than stocks. By having a diversified portfolio, you can reduce the overall impact of market volatility on your investment returns.

Strategies for Investment Diversification

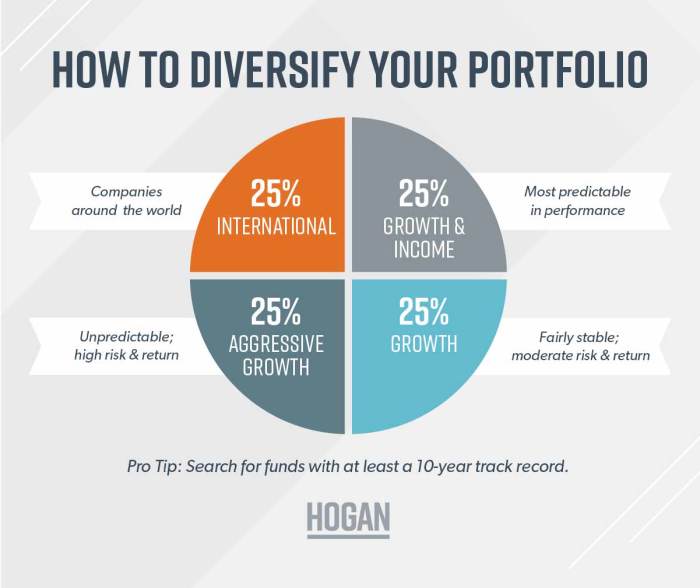

When it comes to investment diversification, there are several strategies that investors can employ to minimize risk and maximize returns.

Asset Allocation Strategies

Asset allocation is a key strategy for diversification, involving spreading investments across various asset classes such as stocks, bonds, real estate, and commodities. By diversifying across different asset classes, investors can reduce the impact of volatility in any one market.

- Determine your risk tolerance and investment goals before allocating assets.

- Consider a mix of high-risk, high-reward investments along with more stable options to balance your portfolio.

- Regularly review and adjust your asset allocation to align with changing market conditions and your investment objectives.

Benefits of Diversifying Across Asset Classes

Diversifying across various asset classes can offer several benefits to investors:

- Reduced risk through exposure to multiple markets and industries.

- Potential for higher returns by capturing growth opportunities in different sectors.

- Protection against market downturns in specific sectors or asset classes.

- Enhanced portfolio resilience in the face of economic uncertainties.

Risks Associated with Lack of Diversification

When investors fail to diversify their investments, they expose themselves to various risks that can significantly impact their portfolios. One of the key risks associated with lack of diversification is concentration risk, which occurs when a portfolio is heavily weighted in a few assets or asset classes.

Concentration Risk and its Impact

Concentration risk can have a devastating impact on investment portfolios, especially when the concentrated assets underperform or face unexpected challenges. By putting all their eggs in one basket, investors increase the vulnerability of their portfolios to the performance of a single asset or sector.

- Concentration risk can lead to massive losses if the focused assets experience a downturn or fail to meet expectations.

- Investors may miss out on potential gains from other profitable opportunities due to lack of diversification.

- In extreme cases, concentration risk can result in the total loss of investment capital if the concentrated asset becomes worthless.

Real-life Examples of Lack of Diversification

One infamous example of the consequences of lack of diversification is the collapse of Enron Corporation in 2001. Enron’s stock was a major component of many investors’ portfolios, and when the company’s fraudulent activities came to light, investors suffered massive losses as the stock plummeted.

Enron’s bankruptcy serves as a stark reminder of the risks associated with over-reliance on a single asset or company.

Tools and Resources for Implementing Diversification

Implementing an investment diversification strategy requires the use of various tools and platforms to effectively spread risk and maximize returns. These tools and resources play a crucial role in helping investors create a well-balanced and diversified portfolio.

Online Investment Platforms

Online investment platforms have made it easier than ever for investors to diversify their portfolios across different asset classes. These platforms offer access to a wide range of investment options, including stocks, bonds, ETFs, and mutual funds. Some popular online investment platforms include:

- Wealthfront

- Betterment

- Robinhood

- Acorns

Risk Assessment Tools

Risk assessment tools help investors evaluate the risk profile of their current investment portfolio. By understanding the level of risk associated with each investment, investors can make informed decisions about how to rebalance their portfolio for optimal diversification. Some common risk assessment tools include:

- Sharpe Ratio

- Standard Deviation

- Value at Risk (VaR)

Portfolio Rebalancing Guide

Rebalancing a diversified investment portfolio is essential to maintain the desired asset allocation and risk profile. Here is a step-by-step guide on how to rebalance your portfolio:

- Evaluate your current asset allocation

- Identify any deviations from your target allocation

- Sell overperforming assets and buy underperforming assets to realign with your target allocation

- Monitor your portfolio regularly and rebalance as needed to adapt to changing market conditions