How to trade forex – a world of opportunity awaits those who dare to venture into the thrilling realm of foreign exchange trading. From understanding the basics to mastering the techniques, this guide will equip you with the knowledge to navigate the forex market like a pro.

Embark on this journey with us as we explore the intricacies of forex trading and unveil the secrets to success in this dynamic and fast-paced industry.

Understand Forex Trading

Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies in the global marketplace. It is one of the largest and most liquid financial markets in the world.

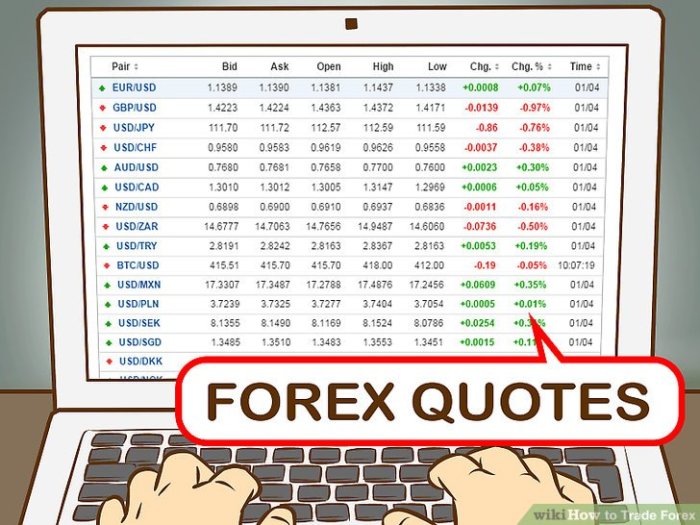

Currency Pairs and Exchange Rates, How to trade forex

When trading forex, currencies are always traded in pairs. The first currency in the pair is called the base currency, while the second currency is known as the quote currency. Exchange rates indicate how much of the quote currency is needed to purchase one unit of the base currency.

Key Players in the Forex Market

- Commercial banks: They are the primary players in the forex market, facilitating most of the trading activities.

- Central banks: Central banks play a crucial role in setting monetary policies and managing currency reserves.

- Hedge funds: Hedge funds engage in speculative trading to profit from currency fluctuations.

- Retail traders: Individual traders participate in the forex market through online platforms and brokers.

Setting Up a Trading Account

To begin trading forex, you need to set up a trading account. This account will serve as your gateway to the forex market, allowing you to buy and sell currencies.When setting up a trading account, follow these steps:

Choosing a Reliable Broker

- Research different brokers to find one that is reputable and regulated by a financial authority.

- Compare trading platforms offered by brokers to ensure they meet your needs.

- Check for competitive spreads and fees to maximize your profitability.

- Read reviews and testimonials from other traders to gauge the broker’s reliability.

Types of Trading Accounts

- Standard Account: Offers fixed spreads and is suitable for beginners.

- Mini Account: Requires a smaller initial deposit and allows traders to trade in smaller increments.

- Managed Account: Where a professional trader manages your account on your behalf.

- Demo Account: Allows you to practice trading with virtual money before risking real funds.

Fundamental Analysis in Forex

Fundamental analysis in forex trading involves evaluating the economic factors that influence the value of a currency. This analysis helps traders make informed decisions based on the overall economic health of a country.

Economic Indicators Impacting Currency Value

Fundamental analysis considers a wide range of economic indicators that can impact currency value. These indicators provide insights into the economic performance of a country and can help traders predict future movements in currency pairs.

- Gross Domestic Product (GDP): GDP measures the total value of all goods and services produced by a country. A strong GDP growth rate is typically positive for a currency.

- Unemployment Rate: The unemployment rate reflects the percentage of the labor force that is unemployed. A high unemployment rate can weaken a currency as it indicates economic instability.

- Inflation Rate: Inflation measures the rate at which prices for goods and services rise. High inflation rates can erode the purchasing power of a currency.

- Interest Rates: Central banks use interest rates to control inflation and economic growth. Higher interest rates can attract foreign investment and strengthen a currency.

- Trade Balance: The trade balance reflects the difference between a country’s exports and imports. A positive trade balance can boost a currency’s value.

Technical Analysis Techniques

When it comes to forex trading, technical analysis plays a crucial role in helping traders make informed decisions based on historical price movements and trends. By utilizing various tools and indicators, traders can identify potential entry and exit points to maximize profits.

Common Technical Analysis Tools

- Support and Resistance Levels: These levels help identify areas where price is likely to bounce or reverse.

- Trend Lines: Used to visualize the direction of the market and potential reversal points.

- Fibonacci Retracement: Helps identify potential levels of support and resistance based on the Fibonacci sequence.

- Candlestick Patterns: Patterns like doji, hammer, and engulfing can signal potential market reversals.

Chart Patterns and Significance

- Head and Shoulders: Indicates a potential reversal in the market.

- Double Top/Bottom: Shows a trend reversal is likely to occur.

- Triangles: Symmetrical, ascending, and descending triangles can signal a breakout or continuation of a trend.

Using Indicators like Moving Averages and RSI

- Moving Averages: Helps smooth out price data to identify trends over a specific period.

- Relative Strength Index (RSI): Measures the speed and change of price movements to determine overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): Shows the relationship between two moving averages to identify potential buy or sell signals.

Risk Management Strategies

When trading forex, it is crucial to have effective risk management strategies in place to protect your capital and minimize potential losses. By implementing techniques like stop-loss orders and position sizing, you can safeguard your investments and improve your overall trading performance.

Stop-Loss Orders

Stop-loss orders are essential tools for managing risk in forex trading. By setting a predetermined price level at which your trade will automatically close, you can limit your losses and protect your capital from significant downturns in the market.

- Place stop-loss orders based on your risk tolerance and trading strategy.

- Adjust stop-loss levels as the market moves to lock in profits or minimize losses.

- Avoid emotional decision-making by relying on stop-loss orders to execute your exit strategy.

Position Sizing

Position sizing is another critical aspect of risk management in forex trading. By determining the appropriate amount of capital to allocate to each trade, you can control the level of risk you are exposed to and avoid overleveraging your account.

- Calculate position size based on your account size, risk tolerance, and stop-loss levels.

- Avoid risking more than a small percentage of your trading capital on any single trade.

- Implement a consistent position sizing strategy to maintain a balanced and sustainable trading approach.

Protecting Your Trading Capital

Protecting your trading capital is paramount to long-term success in forex trading. By following these tips, you can safeguard your investments and maintain a healthy trading account:

- Set realistic profit targets and risk-reward ratios for each trade.

- Diversify your trading portfolio to reduce risk exposure across different currency pairs.

- Regularly review and adjust your risk management strategies to adapt to changing market conditions.

Developing a Trading Plan: How To Trade Forex

When it comes to forex trading, having a solid plan in place is crucial for success. A trading plan Artikels your approach to the market, including your goals, strategies, and risk management techniques. It serves as a roadmap to guide your trading decisions and keep you focused on your objectives.

Components of a Successful Trading Plan

- Clear Goals: Define your financial goals and objectives for trading, whether it’s to generate income, grow your account, or hedge against currency risks.

- Trading Strategy: Artikel your approach to the market, including the currency pairs you will trade, the timeframes you will use, and the indicators or tools you will rely on.

- Risk Management Rules: Establish rules for managing risk, including setting stop-loss orders, determining position sizes, and managing leverage.

- Trading Journal: Keep a detailed record of your trades, including entry and exit points, reasons for the trade, and outcomes. This will help you analyze your performance and identify areas for improvement.

Setting Goals and Sticking to a Strategy

- Setting Specific Goals: Define clear and measurable goals for your trading, such as achieving a certain percentage return on investment or increasing your account size by a specific amount.

- Sticking to Your Strategy: Once you have established a trading plan and strategy, it’s important to stick to it, even when emotions are running high or the market conditions are challenging.

Adapting Your Plan Based on Market Conditions

- Monitoring Market Trends: Stay informed about market trends, economic indicators, and geopolitical events that could impact currency prices. Be prepared to adjust your trading plan based on changing market conditions.

- Flexibility in Trading: While it’s important to have a plan, it’s also essential to be flexible and adapt to new information. Consider adjusting your strategy if your analysis indicates a shift in market dynamics.

Emotional Control and Psychology

When it comes to forex trading, emotions play a significant role in influencing decision-making and overall success. It’s important to understand how to manage these emotions effectively to avoid making impulsive or irrational choices.

The Role of Emotions in Forex Trading

Emotions such as fear, greed, and anxiety can cloud judgment and lead to poor trading decisions. It’s essential to recognize these emotions and learn how to control them to trade effectively.

Tips for Managing Psychological Aspects of Trading

- Acknowledge your emotions: Recognize when you are feeling anxious or overly confident and take a step back to assess the situation.

- Practice mindfulness: Stay present in the moment and avoid dwelling on past trades or worrying about future outcomes.

- Set realistic goals: Establish clear objectives for each trade and avoid letting emotions drive your decisions.

- Utilize stop-loss orders: Implementing stop-loss orders can help limit losses and reduce emotional stress during trading.

- Take breaks: It’s important to step away from the screen and give yourself time to recharge to prevent burnout and emotional fatigue.

Impact of Discipline and Patience on Trading Success

Discipline and patience are crucial traits for successful forex trading. By maintaining discipline in following your trading plan and exercising patience in waiting for the right opportunities, you can improve your overall performance and reduce emotional decision-making.