With how to invest in gold at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling American high school hip style filled with unexpected twists and insights.

Investing in gold has always been a popular choice for those looking to diversify their investment portfolio. From physical gold to gold ETFs, the allure of this precious metal continues to attract investors seeking stability and growth in uncertain times.

Understanding Gold Investment

Investing in gold involves purchasing gold assets with the expectation of generating a profit in the future. This can be done through various forms such as physical gold, gold ETFs, and gold mining stocks.

Reasons for Investing in Gold

- Historical Store of Value: Gold has been considered a reliable store of value for centuries, especially during times of economic uncertainty.

- Diversification: Gold can act as a hedge against inflation and market volatility, diversifying investment portfolios.

- Liquidity: Gold is highly liquid, meaning it can be easily bought or sold in various markets around the world.

Advantages and Disadvantages of Gold Investments

- Advantages:

Gold can provide a safe haven during economic downturns and geopolitical instability.

It can offer protection against currency depreciation and inflation.

- Disadvantages:

Gold does not generate income like dividends or interest, making it less attractive for income-focused investors.

It can be subject to price volatility, affecting short-term investment returns.

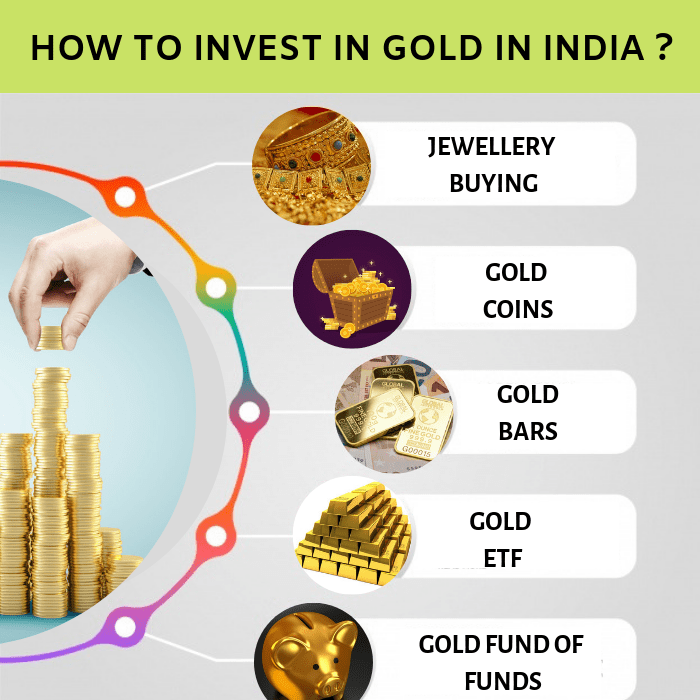

Forms of Gold Investments

- Physical Gold: This involves purchasing gold bars, coins, or jewelry for direct ownership of the precious metal.

- Gold ETFs: Exchange-traded funds (ETFs) are investment funds traded on stock exchanges that track the price of gold.

- Gold Mining Stocks: Investing in companies involved in gold mining operations, with returns tied to the performance of the mining industry.

Factors Influencing Gold Prices

When it comes to understanding the price of gold, there are several key factors that come into play. These factors can range from geopolitical events to economic indicators, all of which can have a significant impact on the value of gold.

Geopolitical Events

Geopolitical events such as wars, political unrest, and trade tensions can greatly influence the price of gold. When there is uncertainty in the global political landscape, investors tend to flock to gold as a safe-haven asset, driving up its price.

Inflation and Interest Rates

Inflation and interest rates also play a crucial role in determining the value of gold. In times of high inflation, the purchasing power of currency decreases, making gold more attractive as a store of value. Additionally, when interest rates are low, the opportunity cost of holding gold diminishes, leading to an increase in demand and price.

Historical Events

Throughout history, there have been several events that have had a significant impact on gold prices. For example, during the 2008 financial crisis, the price of gold surged as investors sought refuge from the uncertainty in the stock market. Similarly, the aftermath of the 9/11 attacks saw a spike in gold prices as investors turned to the precious metal for stability.

Ways to Invest in Gold

Investing in gold can be done through various methods, each with its own set of advantages and considerations. Let’s explore some of the common ways to invest in gold.

Buying Physical Gold

Investors can purchase physical gold in the form of coins, bars, or jewelry. When buying physical gold, it is essential to consider factors such as purity, weight, and authentication. Gold coins like American Eagle and Krugerrand are popular choices for investors looking to own physical gold.

Investing in Gold through Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) offer a convenient way to invest in gold without needing to store physical gold. Investors can buy shares in gold ETFs, which are backed by physical gold held by the fund. This provides exposure to the price of gold without the hassle of owning and storing it.

Investing in Gold Mining Stocks

Another way to invest in gold is through gold mining stocks. By investing in companies that are involved in gold mining operations, investors can gain exposure to the gold market through the performance of these companies. It is essential to research and analyze the financial health and production capacity of these mining companies before investing.

Comparing Different Platforms and Methods

When considering investing in gold, it is crucial to compare different platforms and methods available. Whether choosing to buy physical gold, invest in ETFs, or purchase gold mining stocks, investors should evaluate factors such as liquidity, fees, and potential returns. Each method has its own risks and benefits, so it is important to choose the option that aligns with your investment goals and risk tolerance.

Risks and Considerations

Investing in gold can offer a sense of security and stability, but like any investment, it comes with its own set of risks. It’s important to understand these risks and considerations before diving into the world of gold investments.

Risk Associated with Investing in Gold

- Price Volatility: Gold prices can be highly volatile, affected by economic conditions, geopolitical events, and market speculation. This volatility can lead to sudden and significant fluctuations in the value of your investment.

- Lack of Income: Unlike stocks or bonds, gold does not generate income such as dividends or interest. This means that you rely solely on price appreciation to make a profit.

- Liquidity Risk: Gold investments may lack liquidity, making it difficult to quickly sell your gold holdings for cash, especially during times of economic uncertainty.

Liquidity of Gold Investments

Gold is considered a liquid asset, meaning it can be easily bought or sold in the market. However, the liquidity of gold investments can vary depending on the form of gold you own (physical gold, gold ETFs, gold futures, etc.) and the prevailing market conditions.

Mitigating Risks when Investing in Gold

- Diversification: Spread your investments across different asset classes to reduce the impact of gold price fluctuations on your overall portfolio.

- Research and Due Diligence: Thoroughly research the gold market, understand the factors influencing gold prices, and evaluate the credibility of sellers and investment platforms before making any investment decisions.

- Long-Term Perspective: Consider investing in gold with a long-term perspective to ride out short-term price fluctuations and benefit from the potential long-term growth of the precious metal.

Evaluating the Credibility of Gold Sellers and Investment Platforms

- Check for Accreditation: Look for sellers and platforms that are accredited by reputable organizations or regulatory bodies in the gold industry.

- Read Reviews and Testimonials: Look for feedback from other investors and customers to gauge the reputation and reliability of the seller or platform.

- Transparency and Disclosure: Choose sellers and platforms that provide transparent information about pricing, fees, and terms of the investment to ensure you are making an informed decision.