Get ready to dive into the world of budgeting with a flair that’s as cool as your favorite high school hip hop playlist. This guide will show you how to take charge of your finances and rock your budget like never before.

Whether you’re a budgeting newbie or looking to level up your money game, this guide has got you covered with all the tips and tricks you need to succeed.

Understanding Budgeting

Budgeting is like setting a game plan for your money. It’s all about tracking your income and expenses to make sure you’re not spending more than you earn. This financial tool helps you take control of your finances and achieve your financial goals.

Importance of Budgeting in Personal Finance

Creating and sticking to a budget is crucial for managing your money effectively. It allows you to see where your money is going, identify areas where you can cut back, and prioritize your spending based on your goals. Budgeting helps you avoid debt, save for emergencies, and plan for the future.

Benefits of Creating a Budget

- Helps you track your spending and avoid overspending.

- Allows you to save for short-term and long-term goals.

- Gives you a clear picture of your financial situation.

- Helps you make informed financial decisions.

Setting Financial Goals

Setting financial goals is a crucial step in managing your money effectively. By establishing clear objectives, you can work towards achieving financial success and stability. When it comes to setting financial goals, it’s important to consider both short-term and long-term aspirations.

Short-term and Long-term Financial Goals

- Short-term financial goals typically involve plans for the next few months to a year. These may include building an emergency fund, paying off credit card debt, or saving for a vacation.

- Long-term financial goals, on the other hand, focus on objectives that will take several years to accomplish. Examples of long-term goals include saving for retirement, buying a home, or funding a child’s education.

Aligning your financial goals with a budget is essential for achieving them successfully.

Aligning Goals with a Budget

Creating a budget that reflects your financial goals can help you stay on track and make progress towards achieving them. Here’s how you can align your goals with your budget:

- Evaluate your current financial situation and determine how much you can allocate towards each goal.

- Break down your goals into smaller, manageable milestones to track your progress effectively.

- Adjust your budget as needed to prioritize your goals and ensure you’re making consistent progress towards them.

Tracking Expenses

To stay on top of your budgeting game, tracking your expenses is crucial. By keeping a close eye on where your money is going, you can make informed decisions and adjust your spending accordingly.

Methods to Track Daily Expenses

- Keep a detailed log: Write down every expense, no matter how small, in a notebook or use a budgeting app.

- Use receipts: Save all your receipts and review them regularly to understand your spending patterns.

- Set a budget: Allocate specific amounts for different expense categories and track your progress against these targets.

Importance of Categorizing Expenses

Categorizing expenses helps you identify areas where you may be overspending and allows you to prioritize your spending based on your financial goals.

Tools or Apps to Track Expenses Effectively

- Mint: A popular budgeting app that syncs with your bank accounts and categorizes your expenses automatically.

- YNAB (You Need A Budget): A comprehensive budgeting tool that helps you track expenses, set goals, and manage your finances effectively.

- PocketGuard: This app gives you an overview of your financial situation, tracks your expenses, and helps you stay within your budget limits.

Creating a Budget Plan

Creating a budget plan is essential for managing your finances effectively. It helps you track your income and expenses, prioritize your spending, and work towards your financial goals.

Steps to Create a Personalized Budget Plan

To create a personalized budget plan, follow these steps:

- List all sources of income: Include your salary, side hustle earnings, and any other money coming in.

- Track your expenses: Record all your expenses, from bills to daily purchases, to understand where your money is going.

- Set financial goals: Determine what you want to achieve financially, whether it’s saving for a vacation or paying off debt.

- Allocate funds for different categories: Divide your income into fixed expenses (like rent and utilities), variable expenses (like groceries and entertainment), savings, and debt repayment.

- Monitor and adjust: Regularly review your budget, make adjustments as needed, and stay accountable to your financial plan.

How to Allocate Income for Different Expense Categories

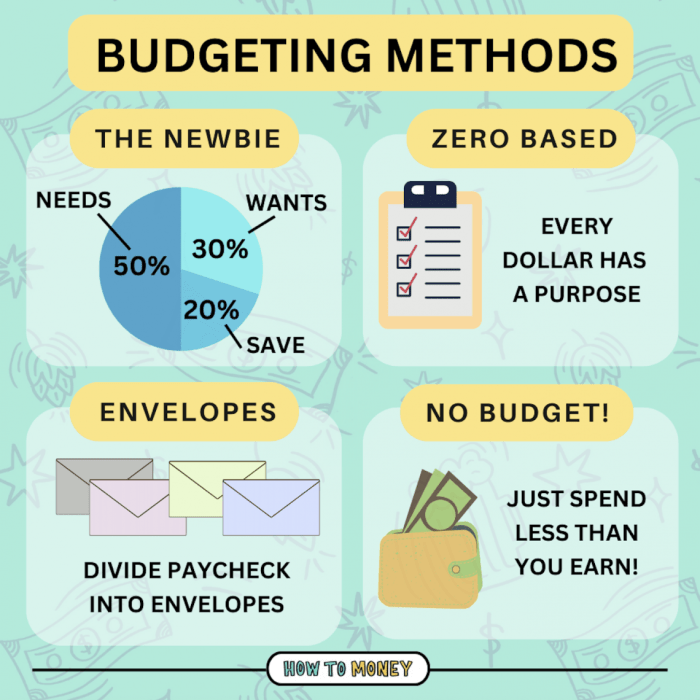

When allocating income for different expense categories, consider the 50/30/20 rule:

Allocate 50% of your income to needs (housing, utilities, groceries), 30% to wants (dining out, entertainment), and 20% to savings and debt repayment.

This guideline can help you balance your spending and prioritize saving for the future.

Tips for Adjusting the Budget as Needed

Adjusting your budget is a normal part of financial planning. Here are some tips for making changes when necessary:

- Identify areas for improvement: Look for expenses you can reduce or eliminate to free up more money for savings or other priorities.

- Be flexible: Life changes, so your budget should too. Allow for adjustments based on unexpected expenses or income fluctuations.

- Stay disciplined: Stick to your budget and resist the temptation to overspend. Remember your financial goals and the importance of staying on track.

Saving and Investing

When it comes to managing your money, saving and investing are crucial aspects that can help secure your financial future. Budgeting plays a key role in ensuring that you have the necessary funds to save and invest wisely.

Allocating Funds Towards Savings and Investments

- Set specific savings goals: Determine how much you want to save and invest each month to reach your financial goals.

- Automate savings: Set up automatic transfers from your checking account to your savings or investment accounts to ensure consistency.

- Prioritize high-interest accounts: Consider putting your savings in accounts with higher interest rates to maximize your returns.

- Invest in diversified portfolios: Spread your investments across different assets to reduce risk and maximize potential returns.

Balancing Saving for the Future with Current Expenses

- Track your expenses: Monitor your spending habits to identify areas where you can cut back and allocate more towards savings and investments.

- Create a budget plan: Use budgeting tools or apps to allocate a portion of your income towards savings and investments each month.

- Set up an emergency fund: Prioritize building an emergency fund to cover unexpected expenses without dipping into your savings or investments.

- Review and adjust: Regularly review your budget to ensure that you are on track with your savings and investment goals, and make adjustments as needed.