Yo, dealing with financial stress ain’t easy, but don’t trip – we got your back! In this dope guide, we’ll break down everything you need to know about managing that money stress like a boss. So, grab a seat and let’s dive in!

Financial stress is no joke – it can mess with your mind and body. Stay tuned to learn how to keep your cool when it comes to cash flow.

Understanding Financial Stress

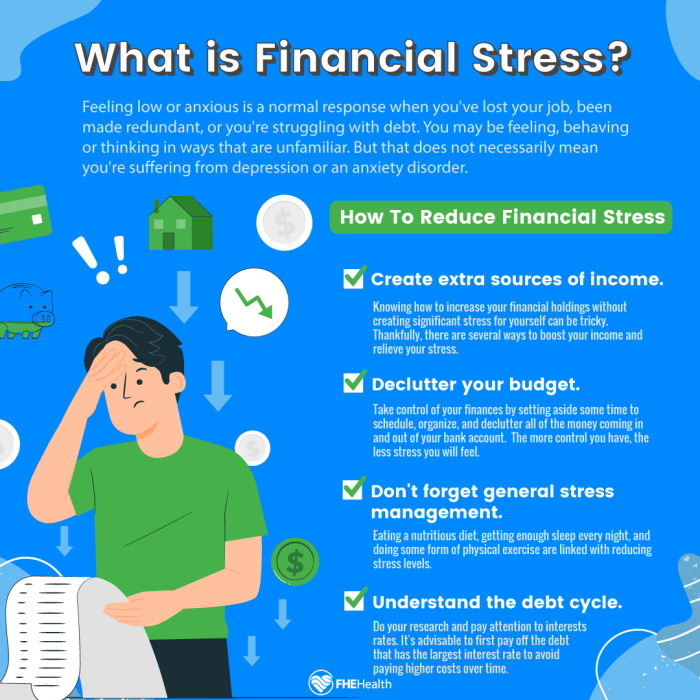

Financial stress is the pressure and anxiety individuals feel due to their financial situation. This can stem from issues such as debt, unemployment, or inability to meet basic needs. The impact of financial stress can be detrimental, affecting mental and physical health in various ways.

Common Causes of Financial Stress

- High levels of debt, including credit cards, student loans, or mortgages.

- Low income or unstable employment, leading to financial instability.

- Lack of savings or emergency funds to cover unexpected expenses.

- Medical bills or other significant financial obligations.

How Financial Stress Can Affect Mental and Physical Health

- Increased levels of anxiety, depression, and overall stress.

- Strain on relationships and social interactions due to financial worries.

- Physical symptoms such as headaches, muscle tension, and fatigue.

- Difficulty focusing or making decisions, impacting work performance.

Identifying Signs of Financial Stress

Financial stress can have a significant impact on an individual’s mental and physical well-being. It is important to be able to recognize the signs and symptoms of financial stress in order to address the issue effectively.

Common Signs and Symptoms of Financial Stress

- Constant worrying about money

- Feeling overwhelmed by debt

- Difficulty sleeping or insomnia

- Increased irritability or mood swings

- Physical symptoms such as headaches or stomach problems

How Financial Stress Can Manifest in Daily Life

Financial stress can manifest in various aspects of daily life, affecting an individual’s overall well-being. For example, it can lead to strained relationships with family and friends, as well as decreased productivity at work due to preoccupation with financial concerns.

Examples of Behaviors Indicating Financial Stress

- Excessive shopping or retail therapy

- Avoiding opening bills or financial statements

- Using credit cards to pay for basic necessities

- Withdrawal from social activities due to financial constraints

- Increased consumption of alcohol or other substances as a coping mechanism

Financial Stress Management Strategies

Managing financial stress effectively is crucial for maintaining overall well-being. By implementing the right strategies, individuals can alleviate the burden of financial worries and take control of their financial situation. Budgeting and financial planning play a key role in stress management, helping individuals track their expenses, set financial goals, and prioritize their spending. Additionally, adopting various coping mechanisms can provide relief and support during challenging times.

Importance of Budgeting and Financial Planning

Budgeting and financial planning are essential tools for managing financial stress. By creating a budget, individuals can gain a clear understanding of their income and expenses, identify areas where they can cut costs, and allocate funds towards savings and debt repayment. Financial planning involves setting short-term and long-term financial goals, such as building an emergency fund, saving for retirement, or paying off debt. By having a solid financial plan in place, individuals can feel more in control of their finances and reduce anxiety related to money management.

Coping Mechanisms for Dealing with Financial Stress

1. Seek support from loved ones: Talking to friends or family members about financial concerns can provide emotional support and guidance.

2. Practice self-care: Engaging in activities that promote relaxation and stress relief, such as exercise, meditation, or hobbies, can help individuals manage stress levels.

3. Focus on what you can control: While some financial challenges may be beyond your control, focusing on small steps you can take to improve your financial situation can empower you to make positive changes.

4. Seek professional help: Consulting a financial advisor or counselor can provide expert guidance on managing finances, creating a budget, and developing a financial plan tailored to your specific needs.

5. Stay positive: Maintaining a positive mindset and practicing gratitude for the things you have can help shift your perspective on financial challenges and build resilience in facing adversity.

Seeking Support for Financial Stress

When dealing with financial stress, seeking support is crucial for managing and overcoming the challenges you may be facing. Whether it’s professional help, resources from organizations, or the support of family and friends, reaching out can make a significant difference in your financial well-being.

Benefits of Seeking Professional Help

Professional help for financial stress can provide you with expert guidance and tailored solutions to address your specific financial situation. Financial counselors or therapists can help you create a budget, prioritize expenses, and develop a plan to reduce debt and increase savings.

Resources and Organizations for Financial Stress Management

- Financial Counseling Services: Organizations like the National Foundation for Credit Counseling (NFCC) offer free or low-cost financial counseling services to help you manage debt, budget effectively, and improve your financial literacy.

- Online Resources: Websites like Mint, Personal Capital, and NerdWallet provide tools and resources for budgeting, tracking expenses, and setting financial goals.

- Government Assistance Programs: Programs like the Supplemental Nutrition Assistance Program (SNAP) and Low-Income Home Energy Assistance Program (LIHEAP) can offer support with food and utility expenses.

Role of Family and Friends in Supporting Individuals

Family and friends can play a crucial role in supporting individuals dealing with financial stress. They can offer emotional support, practical help, and a listening ear during challenging times. Additionally, they can provide valuable advice, share resources, and help you navigate financial decisions.