Diving deep into the world of finance management apps, this introduction sets the stage for an exploration of how these digital tools revolutionize the way we handle our finances. From tracking expenses to integrating seamlessly with banks, get ready for a wild ride through the world of finance management apps.

Get ready to discover the top finance management apps in the market, understand their security measures, and learn about their integration capabilities.

Benefits of Finance Management Apps

Finance management apps are essential tools that help users track their expenses, manage their budgets, and stay on top of their financial goals. These apps offer a wide range of benefits that make managing finances easier and more efficient.

Tracking Expenses

- Finance management apps allow users to track their expenses in real-time, categorize transactions, and analyze spending patterns.

- Users can set budgets for different categories and receive notifications when they are close to exceeding their limits.

- By tracking expenses consistently, users can identify areas where they can cut back and save money.

User-Friendly Features

- Most finance management apps have intuitive interfaces that make it easy for users to input and access their financial information.

- Features like automatic categorization of transactions, bill reminders, and customizable budgeting tools simplify the process of managing finances.

- Many apps also offer syncing capabilities with bank accounts and credit cards, providing users with a comprehensive view of their financial situation.

Advantages Over Traditional Methods

- Finance management apps eliminate the need for manual calculations and paper-based tracking systems, saving users time and reducing the risk of errors.

- Users can access their financial information anytime, anywhere, making it convenient to stay organized and make informed financial decisions on the go.

- With features like data encryption and secure login credentials, finance management apps offer a high level of security to protect users’ sensitive financial data.

Top Finance Management Apps in the Market

When it comes to managing your finances, having the right tools can make all the difference. Here are some of the top finance management apps available in the market today, each offering unique features to help you stay on top of your financial game.

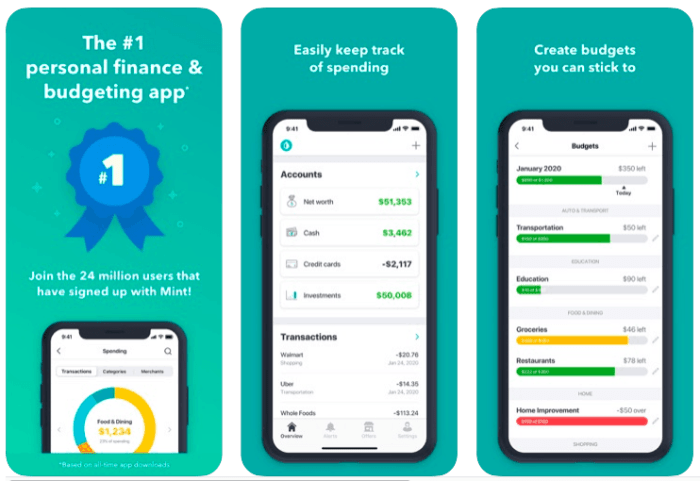

1. Mint

Mint is a popular finance management app available for both iOS and Android users. It allows you to track your spending, create budgets, and receive alerts for upcoming bills. With its intuitive interface and customizable categories, Mint makes it easy to keep tabs on your finances. User reviews praise Mint for its user-friendly design and comprehensive financial tracking capabilities.

2. YNAB (You Need A Budget)

YNAB is another top finance management app that focuses on budgeting and goal-setting. Available for iOS, Android, and web users, YNAB helps you allocate your income towards specific goals and expenses. Users appreciate the app’s proactive approach to budgeting and its emphasis on giving every dollar a job.

3. Personal Capital

Personal Capital is a finance management app geared towards investment tracking and retirement planning. With tools for analyzing investment portfolios and monitoring retirement accounts, Personal Capital is a great choice for those looking to grow their wealth. Users commend the app for its investment insights and retirement planning features.

Security Measures in Finance Management Apps

When it comes to finance management apps, security is a top priority to protect user data and financial information. These apps implement various security protocols to ensure the safety of sensitive information.

End-to-End Encryption

One of the common security features in finance management apps is end-to-end encryption. This means that data is encrypted on the user’s device before being transmitted and can only be decrypted by the recipient, ensuring that even if intercepted, the data remains secure.

Biometric Authentication

Many finance management apps also offer biometric authentication, such as fingerprint or face recognition, to provide an extra layer of security. This ensures that only authorized users can access the financial information stored in the app.

Two-Factor Authentication

Another security measure employed by finance management apps is two-factor authentication. This requires users to provide two forms of identification before gaining access to the app, adding an extra level of protection against unauthorized access.

Regular Security Updates

Finance management apps frequently update their security features to stay ahead of potential threats. These updates often include patches for any vulnerabilities that may have been identified, ensuring that user data remains safe and secure.

Comparison of Security Features

Different finance management apps may vary in the security features they offer. While some may prioritize end-to-end encryption and biometric authentication, others may focus more on two-factor authentication and regular security updates. It’s essential for users to choose an app that aligns with their security preferences and needs.

Integration Capabilities of Finance Management Apps

Finance management apps offer seamless integration with banks and financial institutions, providing users with a comprehensive overview of their financial transactions and accounts in one centralized platform.

Syncing Accounts and Transactions

Users can sync their bank accounts and credit cards with finance management apps by securely linking their accounts through a secure API connection. This allows the app to access real-time transaction data and account balances, providing users with up-to-date information on their finances.

Benefits of Seamless Integration

- Convenience: Users can view all their financial information in one place without the need to log in to multiple accounts.

- Automatic Updates: Transactions are automatically categorized and updated, saving users time and effort in manually inputting data.

- Real-time Monitoring: Users can track their spending and budget in real-time, helping them make informed financial decisions.

- Improved Accuracy: With automated syncing, there is less room for human error in tracking financial transactions.