Dive into the world of Dividend investing strategies where smart financial decisions pave the way to long-term wealth and success. Discover the ins and outs of this investment approach, from selecting the right stocks to maximizing returns.

Get ready to explore the realm of dividends and how they can play a crucial role in building a robust investment portfolio.

Introduction to Dividend Investing

Dividend investing is a strategy where investors focus on buying shares of companies that regularly pay out dividends to their shareholders. These dividends are a portion of the company’s profits distributed to investors as a form of return on their investment. Dividend investing is important in a portfolio as it provides a steady stream of income, which can be particularly beneficial for retirees or those looking for passive income.

Unlike other investment strategies that rely solely on capital appreciation, dividend investing offers the potential for regular cash flow regardless of market conditions. This can help mitigate the impact of market volatility and provide a more stable return on investment over the long term.

Some popular dividend-paying stocks include blue-chip companies like Johnson & Johnson, Coca-Cola, and Procter & Gamble. These companies have a history of consistently paying dividends and increasing them over time, making them attractive choices for dividend investors looking for reliable income streams.

Benefits of Dividend Investing

When it comes to investing, dividend-paying stocks offer a range of advantages that can benefit investors in the long run. One of the key benefits is the potential for a reliable income stream through regular dividend payments. This can provide investors with a steady cash flow, which can be particularly appealing for those looking to supplement their income or build wealth over time.

Steady Income Stream

- Dividends can provide a consistent source of income, which can be especially beneficial during times of market volatility or economic uncertainty.

- Investors can reinvest these dividends to purchase more shares, leading to potential growth in their overall investment portfolio.

Long-Term Returns

- Historically, dividend-paying stocks have outperformed non-dividend-paying stocks over the long term.

- Dividend stocks tend to be more stable and less volatile compared to growth stocks, offering investors a sense of security and predictability.

- Reinvesting dividends can compound returns over time, resulting in higher overall gains for investors.

Strategies for Selecting Dividend Stocks

When it comes to choosing dividend stocks, it’s essential to have a solid strategy in place. By evaluating certain criteria, analyzing a company’s dividend history, and understanding the concept of dividend yield, investors can make informed decisions to build a profitable portfolio.

Criteria for Evaluating Dividend-Paying Companies

- Consistent Dividend Payments: Look for companies that have a track record of paying dividends regularly.

- Dividend Growth: Companies that consistently increase their dividend payouts over time are usually a good choice.

- Stable Earnings: Companies with stable earnings are more likely to sustain their dividend payments.

- Low Debt Levels: Avoid companies with high debt levels, as they may struggle to maintain dividend payments during tough times.

Analyzing a Company’s Dividend History and Sustainability

- Check for Dividend Growth: Analyze the company’s historical dividend payments to see if they have been increasing over time.

- Dividend Payout Ratio: Evaluate the company’s dividend payout ratio to ensure that it is sustainable and not eating into profits needed for growth.

- Dividend Coverage Ratio: Look at the company’s ability to cover its dividend payments with earnings. A ratio above 1 indicates the company can afford its dividends.

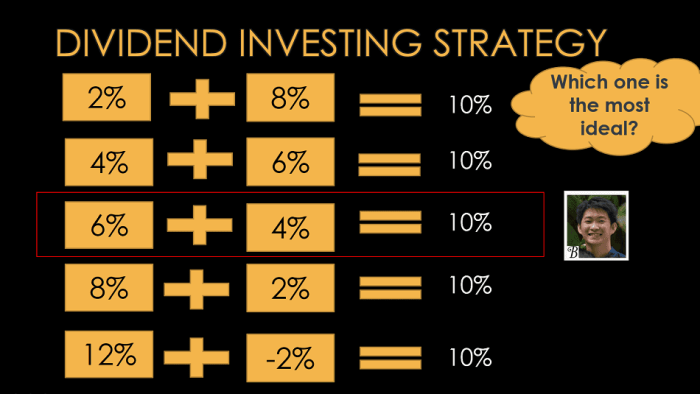

Understanding Dividend Yield and Its Significance in Stock Selection

- Dividend Yield Calculation: Dividend yield is calculated by dividing the annual dividend per share by the stock price. It represents the percentage return on investment from dividends alone.

- Significance in Stock Selection: A higher dividend yield may indicate an attractive investment opportunity, but it’s essential to consider other factors like sustainability and growth potential.

- Comparing Dividend Yields: Compare dividend yields across different companies within the same industry to identify potential opportunities for higher returns.

Reinvestment Strategies for Dividends

When it comes to reinvesting dividends, there are several options available to investors that can have a significant impact on long-term wealth accumulation. By choosing the right reinvestment strategy, investors can optimize their returns and grow their wealth over time.

Dividend Reinvestment Plans (DRIPs)

- DRIPs allow investors to automatically reinvest their dividends back into the same stock that paid them out.

- This strategy can help compound returns over time as investors buy more shares without incurring additional fees.

- DRIPs are a convenient way to reinvest dividends without having to manually purchase more shares.

Manual Reinvestment

- Investors can also choose to manually reinvest their dividends by using the cash payouts to buy more shares of dividend-paying stocks.

- This hands-on approach gives investors more control over their reinvestment decisions and allows for more flexibility in choosing when and where to reinvest.

- Manual reinvestment can be beneficial for investors who want to strategically allocate their dividend income across different stocks in their portfolio.

Impact of Reinvesting Dividends

Reinvesting dividends can significantly accelerate the growth of an investment portfolio over time due to the power of compounding returns.

- By reinvesting dividends, investors can benefit from the snowball effect of compounding, where reinvested dividends generate additional income that is reinvested to generate even more income.

- Over the long term, this compounding effect can lead to exponential growth in wealth accumulation compared to simply receiving and holding onto dividend payouts.

Tips for Optimizing Dividend Reinvestment

- Consider reinvesting dividends in stocks that have a history of increasing dividends over time, as this can lead to higher returns and more consistent income.

- Monitor your dividend reinvestment plan regularly to ensure that it aligns with your investment goals and risk tolerance.

- Reinvest dividends strategically based on market conditions and your overall investment strategy to maximize returns and minimize risks.

Risks and Challenges in Dividend Investing

When it comes to dividend investing, there are certain risks and challenges that investors need to be aware of in order to make informed decisions.

Potential Risks Associated with Dividend Stocks

- Market Volatility: Dividend stocks can be impacted by market fluctuations, leading to potential declines in stock prices.

- Dividend Cuts: Companies may reduce or eliminate dividend payments due to financial difficulties, impacting investor returns.

- Interest Rate Changes: Rising interest rates can make dividend stocks less attractive compared to fixed-income investments.

- Company Performance: Poor financial performance or management decisions can affect a company’s ability to sustain dividend payments.

How Economic Conditions Affect Dividend Payments

- Economic Downturns: During recessions or economic downturns, companies may struggle to maintain dividend payments as revenue and earnings decline.

- Inflation: High inflation rates can erode the purchasing power of dividend income over time, affecting the real return on investment.

- Currency Fluctuations: Companies operating globally may face currency risks that impact the value of dividend payments for investors.

Strategies for Managing Risks in a Dividend-focused Portfolio

- Diversification: Spread investments across different sectors and industries to reduce the impact of poor performance in a single company.

- Research and Due Diligence: Conduct thorough analysis of company financials, dividend history, and market trends before investing in dividend stocks.

- Monitor Portfolio: Regularly review and adjust your portfolio based on changes in company fundamentals, economic conditions, and market trends.

Tax Implications of Dividend Investing

When it comes to dividend investing, understanding the tax implications is crucial for maximizing your returns. Dividends are taxed differently from capital gains, so let’s dive into the details.

Tax Treatment of Dividends

- Dividends are typically taxed at a lower rate than ordinary income, known as the qualified dividend tax rate. This rate is based on the individual’s tax bracket, with the maximum rate currently at 20% for high-income earners.

- On the other hand, capital gains are taxed based on how long the investment was held before selling, with short-term gains taxed at ordinary income rates and long-term gains taxed at lower rates.

Tax Advantages and Disadvantages

- One advantage of dividend investing is the potentially lower tax rate on dividends compared to other types of income. This can lead to higher after-tax returns for investors.

- However, a disadvantage is that dividends are taxable in the year they are received, regardless of whether they are reinvested. This can create a tax burden for investors, especially if they receive significant dividend income.

Tax Planning Strategies

- Consider holding dividend-paying stocks in tax-advantaged accounts like IRAs or 401(k)s to defer taxes on dividends until withdrawal.

- Strategically reinvest dividends to avoid immediate tax implications and benefit from compounding growth over time.

- Monitor your tax bracket and consider timing dividend payments to minimize tax impact, especially if you are close to moving into a higher tax bracket.