Budgeting for Families sets the stage for financial success, offering a roadmap for families to navigate their way to stability and prosperity. From setting realistic goals to managing expenses, this guide dives deep into the world of family budgeting with a modern twist.

Importance of Budgeting for Families

Budgeting is crucial for families as it allows them to track their income and expenses effectively, ensuring that they are living within their means and saving for the future. Without a budget, families may overspend, accumulate debt, and struggle to meet their financial obligations.

Financial Goals Achievement

Creating a budget helps families set and achieve their financial goals. By carefully planning how their income will be allocated towards expenses, savings, and investments, families can work towards milestones such as buying a home, funding education, or building an emergency fund.

Hey there, you want to step up your marketing game and reach a wider audience? Check out this dope article on Developing a Multi-Channel Marketing Plan. It’s all about expanding your reach through various channels like social media, email, and more. Don’t sleep on this opportunity to level up your marketing strategy!

Improved Family Relationships

Budgeting can improve family relationships by fostering communication and teamwork. When all family members are involved in the budgeting process, they develop a shared understanding of financial priorities and work together towards common goals. This collaboration can reduce conflicts over money and strengthen family bonds.

Yo, developing a multi-channel marketing plan is crucial in today’s digital world. It’s all about reaching your audience in different ways, from social media to email campaigns. Check out this dope article on Developing a Multi-Channel Marketing Plan for some killer tips and tricks to boost your marketing game!

Creating a Family Budget: Budgeting For Families

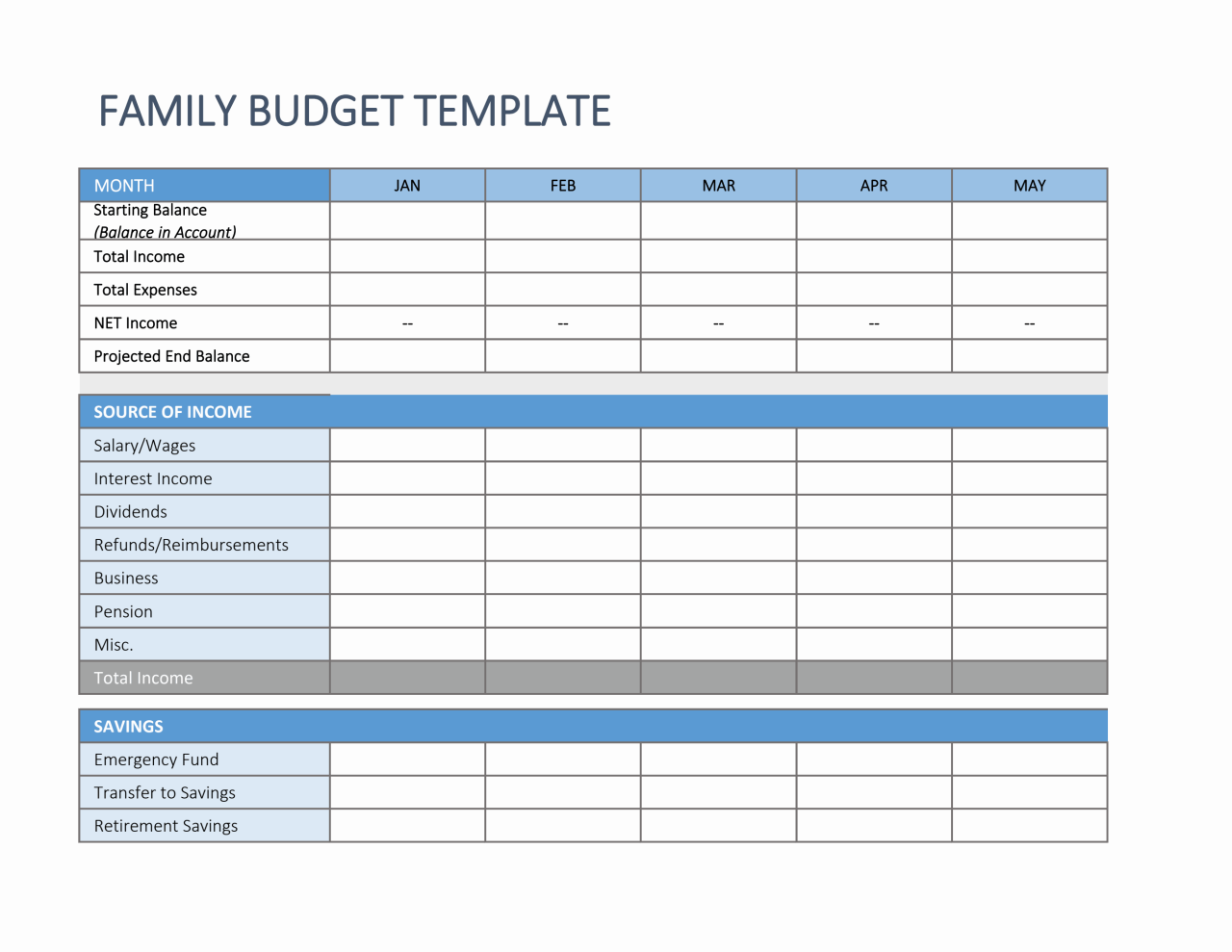

Budgeting for families is a crucial step in managing finances effectively and achieving financial goals. Here are the steps to create a family budget:

Step 1: Calculate Income

- List all sources of income for the family, including salaries, bonuses, and any other earnings.

- Determine the total monthly income by adding up all sources of income.

Step 2: Track Expenses

- Record all expenses, including bills, groceries, entertainment, and other spending.

- Categorize expenses to identify areas where you can potentially cut back.

Step 3: Set Financial Goals

- Discuss with your family members to determine short-term and long-term financial goals.

- Set specific and realistic goals, such as saving for a vacation or paying off debt.

Involving Family Members

To involve all family members in the budgeting process:

- Hold regular family meetings to discuss finances and budget updates.

- Assign responsibilities to each family member, such as tracking expenses or researching cost-saving tips.

Importance of Setting Realistic Goals

Setting realistic financial goals within the budget is essential because:

- It provides a clear target to work towards, motivating the family to stick to the budget.

- Realistic goals help track progress and celebrate achievements along the way.

Managing Household Expenses

When it comes to managing household expenses, families need to be diligent in budgeting for various essential costs. By identifying common expenses, implementing strategies to save money, and tracking spending, families can ensure financial stability.

Identifying Common Household Expenses

Before creating a family budget, it’s crucial to identify the common expenses that need to be accounted for. These may include:

- Mortgage or Rent

- Utilities (Electricity, Water, Gas)

- Groceries

- Insurance (Health, Home, Auto)

- Transportation (Gas, Maintenance, Public Transit)

- Childcare or Education Costs

- Debt Payments (Credit Cards, Loans)

Strategies for Reducing Expenses and Saving Money

Reducing expenses and saving money within a family budget can be achieved through various strategies:

- Meal Planning: By planning meals in advance and cooking at home, families can save on dining out expenses.

- Energy Efficiency: Implementing energy-saving practices can help lower utility bills.

- Couponing and Shopping Sales: Utilizing coupons and shopping during sales can lead to significant savings on groceries and household items.

- Limiting Impulse Purchases: Setting a budget and avoiding impulse buys can prevent unnecessary spending.

- Comparison Shopping: Researching prices before making purchases can ensure families get the best deals.

Importance of Tracking Expenses and Making Adjustments

Tracking expenses is essential for staying within budget and making necessary adjustments. By keeping a close eye on spending habits, families can:

- Identify Areas of Overspending: Tracking expenses helps pinpoint areas where money is being unnecessarily spent.

- Make Informed Decisions: Understanding where money is going allows families to make informed decisions about where to cut back.

- Adjust Budget as Needed: Regularly reviewing expenses and income enables families to adjust their budget to meet financial goals.

Teaching Kids about Budgeting

Teaching kids about budgeting is crucial to help them develop essential financial skills from a young age. It sets the foundation for responsible money management and helps them understand the value of money.

Importance of Teaching Kids about Budgeting

- Introducing budgeting concepts to kids early on can instill good financial habits that will benefit them throughout their lives.

- Teaching kids about budgeting promotes financial literacy and empowers them to make informed decisions about money.

- It helps children differentiate between needs and wants, teaching them to prioritize their spending.

Age-Appropriate Ways to Introduce Budgeting Concepts to Kids

- Start with simple concepts like saving money in a piggy bank or setting a spending limit for their allowance.

- Involve kids in household budget discussions to help them understand how money is allocated for different expenses.

- Use games or activities that involve budgeting, such as creating a grocery shopping list within a budget or planning a pretend vacation with limited funds.

Long-Term Benefits of Instilling Good Financial Habits in Children

- Children who learn about budgeting early are more likely to become financially responsible adults.

- Teaching kids about budgeting can help them avoid debt and make wise financial choices in the future.

- Instilling good financial habits in children can lead to increased financial independence and confidence in managing their money.

Emergency Funds and Savings

Having an emergency fund is crucial in a family budget to prepare for unexpected financial challenges that may arise. It serves as a safety net to cover unforeseen expenses and helps prevent falling into debt during tough times.

Building Up Savings, Budgeting for Families

- Set a savings goal: Determine how much you want to save each month and prioritize it in your budget.

- Automate savings: Set up automatic transfers from your checking account to your savings account to ensure consistent savings.

- Cut back on non-essential expenses: Identify areas where you can reduce spending to free up more money for savings.

- Take advantage of windfalls: Allocate unexpected income like bonuses or tax refunds towards your savings goal.

Handling Unexpected Financial Challenges

- Assess the situation: Evaluate the impact of the financial challenge on your budget and determine the best course of action.

- Adjust your budget: Reallocate funds from non-priority areas to cover the unexpected expense without jeopardizing essential expenses.

- Explore additional income sources: Consider taking on extra work or selling items to generate quick cash to address the financial challenge.

- Utilize your emergency fund: If the unexpected expense exceeds your regular budget, dip into your emergency fund to cover the shortfall.