Step into the world of investment research where every decision can make or break your portfolio. From fundamental analysis to staying updated with market trends, this topic is a goldmine waiting to be explored. Get ready for a deep dive into the realm of investment strategies and uncover the best practices that can lead you to financial success.

In this article, we will unravel the mysteries behind investment research, guiding you through the intricate process of making informed decisions that can shape your financial future.

Introduction to Investment Research

Investment research is the process of gathering, analyzing, and interpreting information to make informed decisions about investments. It plays a crucial role in helping investors identify opportunities, assess risks, and ultimately maximize returns on their investments.

Importance of Investment Research

Investment research is essential for investors to make well-informed decisions that align with their financial goals. By conducting thorough research, investors can better understand market trends, company performance, and economic indicators, allowing them to make strategic investment choices.

- Research helps investors identify undervalued assets and potential growth opportunities.

- It allows investors to assess the risk associated with different investment options and develop a diversified portfolio to mitigate risk.

- Research enables investors to stay informed about market developments and adjust their investment strategies accordingly.

“Research is the key to making sound investment decisions and achieving long-term financial success.”

Role of Investment Research in Decision-Making

Investment research plays a crucial role in the decision-making process by providing investors with the necessary information to evaluate investment opportunities effectively. It helps investors make informed choices based on data-driven insights rather than relying solely on speculation or emotions.

- Research helps investors assess the financial health and performance of companies to determine their investment potential.

- It provides valuable insights into market trends, economic conditions, and industry developments that can impact investment outcomes.

- By conducting research, investors can make educated decisions about when to buy, sell, or hold investments to optimize their returns.

“Investment research empowers investors to make informed decisions that align with their financial objectives and risk tolerance.”

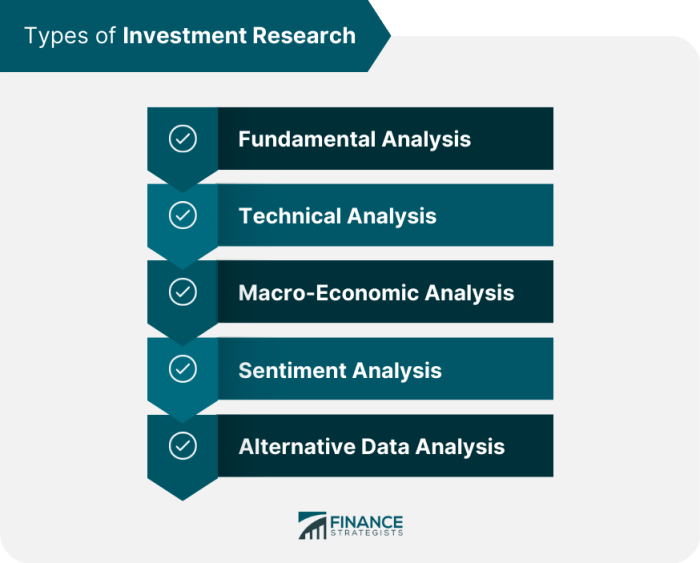

Types of Investment Research

Investment research involves various methods and approaches to analyze potential investment opportunities. Let’s dive into the different types of investment research to understand how they can help investors make informed decisions.

Fundamental Analysis

Fundamental analysis is a method of evaluating a security by analyzing various factors that could influence its intrinsic value. Key components of fundamental analysis include:

- Earnings per share (EPS): A company’s profit divided by the number of outstanding shares.

- Price-to-earnings (P/E) ratio: The ratio of a company’s share price to its earnings per share.

- Revenue growth: The rate at which a company’s sales are increasing over time.

Technical Analysis

Technical analysis focuses on analyzing historical price and volume data to predict future price movements. It is based on the premise that past price movements can help forecast future trends. Some key aspects of technical analysis include:

- Support and resistance levels: Price levels where a stock tends to stop and reverse direction.

- Chart patterns: Recognizable patterns in price charts that can indicate potential future price movements.

- Indicators: Mathematical calculations based on price and volume data to help identify market trends.

Quantitative vs. Qualitative Research

Quantitative research involves analyzing numerical data and using statistical models to make investment decisions. On the other hand, qualitative research focuses on non-numerical information such as management quality, industry trends, and competitive positioning. Both methods have their strengths and weaknesses, and investors often use a combination of quantitative and qualitative research to gain a holistic view of an investment opportunity.

Best Practices for Conducting Investment Research

When it comes to conducting thorough investment research, there are several key steps that investors should follow to make informed decisions and maximize their potential returns.

Identifying Reliable Sources of Information

- Look for information from reputable financial news outlets and websites.

- Consult reports and analysis from established investment research firms.

- Consider information from regulatory bodies and government agencies.

- Verify the credibility of sources by cross-referencing information from multiple reliable sources.

Staying Updated with Market Trends

Keeping up with market trends is crucial for successful investment research as it allows investors to adapt their strategies and make timely decisions based on current market conditions. Here are some tips for staying updated:

- Regularly monitor financial news and updates from reliable sources.

- Utilize financial analysis tools and software to track market trends and performance.

- Engage with industry experts and attend conferences or seminars to gain insights into market developments.

- Join investment forums and communities to discuss market trends and share knowledge with other investors.

Tools and Resources for Investment Research

Investment research requires the use of various tools and resources to gather and analyze crucial data for making informed decisions. Utilizing the right tools can significantly enhance the quality of your research and ultimately lead to better investment outcomes.

Essential Tools for Investment Research

- Financial Databases: Access to reliable financial databases such as Bloomberg, Reuters, and Morningstar can provide valuable information on market trends, company financials, and industry analysis.

- Analysis Software: Utilizing tools like Excel, MATLAB, or specialized investment analysis software can help in crunching numbers, conducting financial modeling, and performing scenario analysis.

- Online Platforms: Websites like Yahoo Finance, Seeking Alpha, and CNBC offer a wealth of information, including market news, stock analysis, and expert opinions.

Effectively Utilizing Online Platforms for Investment Research

- Filter Information: Use advanced search and filter options on online platforms to narrow down your research focus and access relevant data quickly.

- Follow Experts: Subscribe to newsletters, blogs, and social media accounts of reputable analysts and investment professionals to stay updated on market trends and insights.

- Join Forums: Participate in investment forums and communities to discuss investment ideas, share knowledge, and gain insights from fellow investors.

Recommendations for Reputable Research Sources and Databases

- Financial Times: A trusted source for global financial news, analysis, and market insights.

- Investopedia: Offers comprehensive educational resources, investing tutorials, and financial definitions.

- SEC Edgar Database: Access to company filings, financial reports, and other regulatory information directly from the Securities and Exchange Commission.