Budgeting techniques are essential for financial success, whether you’re a high school student saving up for prom or a young adult navigating your first job. From zero-based budgeting to the 50/30/20 rule, this guide will help you take control of your money like a boss.

Learn how to create a budget, track your expenses, and leverage technology to make informed financial decisions. Get ready to level up your money management game and secure a bright financial future!

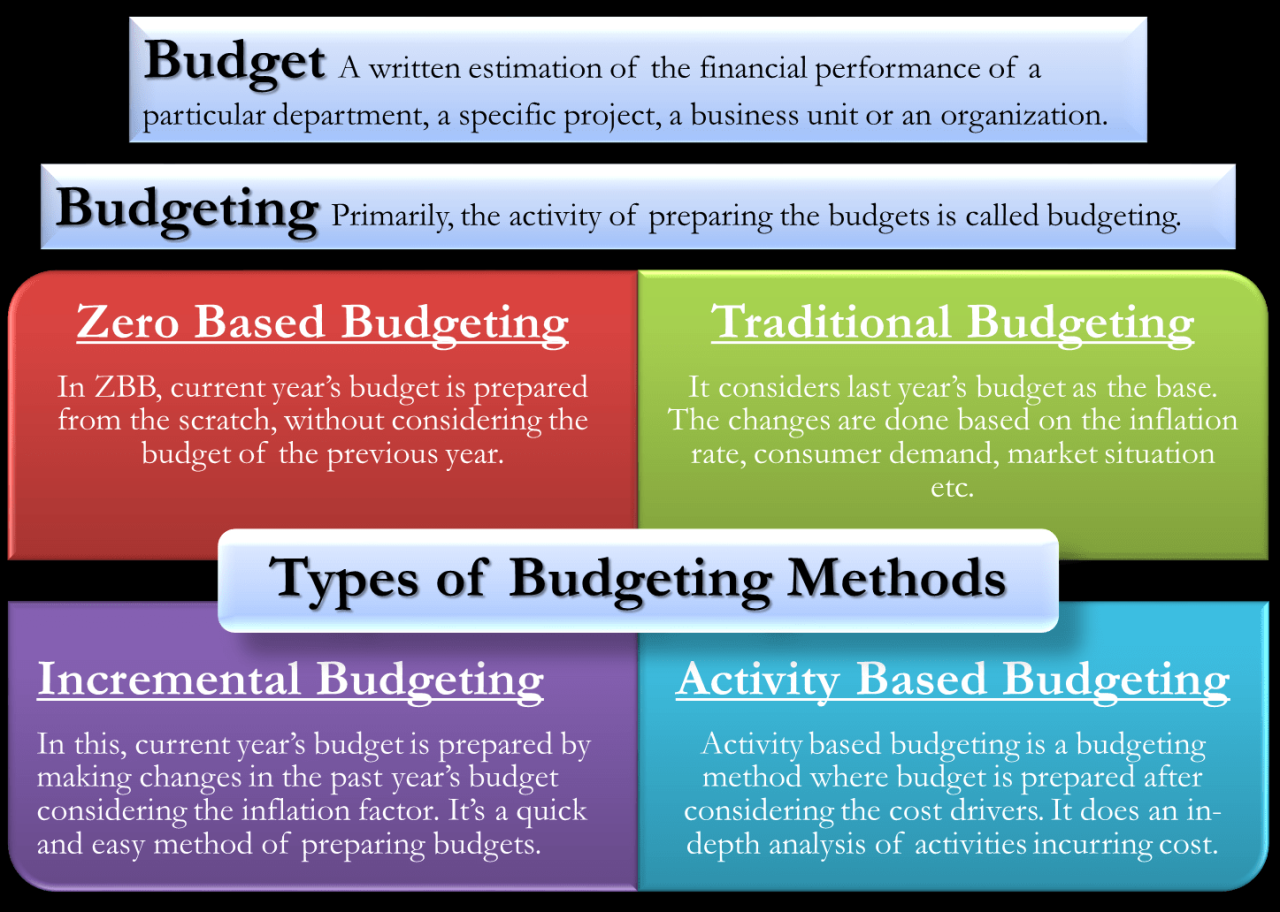

Types of Budgeting Techniques

Budgeting techniques are essential tools for individuals and organizations to manage their finances effectively. Let’s explore some common types of budgeting techniques.

Zero-Based Budgeting

Zero-based budgeting is a method where the budget starts from zero each fiscal year. Instead of basing the new budget on the previous year’s budget, every expense must be justified from scratch. This approach forces companies to evaluate each expense carefully, leading to better cost control and resource allocation.

Incremental Budgeting vs. Activity-Based Budgeting

Incremental budgeting involves making small adjustments to the previous budget, usually by adding a percentage increase for inflation or anticipated growth. In contrast, activity-based budgeting focuses on the cost of specific activities or processes within an organization. By allocating resources based on activities, companies can align their budget with strategic goals more effectively.

Rolling Budgets for Financial Planning

Rolling budgets are financial plans that continuously update and extend into future periods. As each month or quarter passes, a new month or quarter is added to the end of the budget, maintaining a constant planning horizon. This flexibility allows companies to adapt to changing circumstances and make informed decisions based on the most up-to-date information available.

Personal Budgeting Strategies

Creating a monthly budget is essential for managing your finances effectively. By outlining your income and expenses, you can gain better control over your spending habits and save for future goals.

Envelope System for Managing Expenses

The envelope system is a simple yet effective way to allocate your funds for different categories of expenses. Here’s how it works:

- Create envelopes for different expenses such as groceries, entertainment, and transportation.

- Determine the amount of money you will allocate to each category based on your budget.

- Place the designated cash amount in each envelope at the beginning of the month.

- Only use the cash from each envelope for its designated expense category.

- Once an envelope is empty, you cannot spend more on that category until the next month.

Importance of Tracking Expenses in Budgeting

Tracking your expenses is crucial for staying within your budget and identifying areas where you may be overspending. By keeping a record of every purchase, you can analyze your spending patterns and make necessary adjustments to achieve your financial goals.

Advanced Budgeting Methods

When it comes to advanced budgeting methods, there are a few strategies that can help you take your financial planning to the next level. Let’s dive into some of these techniques below.

Using the 50/30/20 Rule for Budgeting

The 50/30/20 rule is a popular budgeting method that involves dividing your after-tax income into three categories. Here’s how it works:

- 50% of your income goes towards needs such as rent, utilities, groceries, and other essential expenses.

- 30% of your income is allocated to wants, which include non-essential expenses like dining out, entertainment, and shopping.

- 20% of your income is earmarked for savings and debt repayment, helping you build an emergency fund and pay off debts faster.

Cash Flow-Based Budgeting Method

Cash flow-based budgeting is a method that focuses on tracking the actual flow of money in and out of your accounts. This approach involves:

- Monitoring your income and expenses on a regular basis to ensure that you have enough cash to cover your bills and financial goals.

- Adjusting your budget as needed based on changes in income or expenses, helping you stay flexible and responsive to your financial situation.

- Utilizing tools such as cash flow statements and budgeting apps to streamline the process and gain insights into your spending habits.

Benefits of Bi-Weekly Budgeting Approach

A bi-weekly budgeting approach offers several advantages for individuals looking to manage their finances more effectively:

- Helps you align your budget with your pay schedule, making it easier to allocate funds for bills, savings, and other financial goals.

- Allows you to break down your monthly expenses into smaller, manageable chunks, reducing the risk of overspending or falling behind on payments.

- Enables you to take advantage of bi-weekly paychecks to make extra debt payments or contributions to savings, accelerating your progress towards financial freedom.

Technology in Budgeting: Budgeting Techniques

Technology has revolutionized the way we manage our finances, making budgeting more accessible and convenient than ever before. From popular budgeting apps to advanced automation tools, technology plays a crucial role in helping individuals track their expenses and make informed financial decisions.

Popular Budgeting Apps and Features

- One popular budgeting app is Mint, which allows users to link their bank accounts, track spending, set financial goals, and receive personalized money-saving tips.

- Another well-known app is YNAB (You Need A Budget), which emphasizes zero-based budgeting and provides tools for tracking transactions and creating detailed spending reports.

- PocketGuard is a user-friendly app that offers a snapshot of your financial situation, categorizes expenses, and helps identify areas where you can save money.

Role of Automation in Budget Tracking, Budgeting techniques

- Automation simplifies the budgeting process by automatically categorizing transactions, setting spending limits, and sending alerts for overspending.

- Features like recurring bill payments and automatic savings transfers help users stay on track with their financial goals without manual intervention.

- By eliminating the need for manual data entry, automation saves time and reduces the risk of human error in budget tracking.

Data Analytics for Enhanced Budgeting Decisions

- Data analytics tools can analyze spending patterns, identify trends, and provide insights into areas where budget adjustments are needed.

- By harnessing the power of data, individuals can make informed decisions about their finances, optimize their budget, and plan for future expenses more effectively.

- Utilizing data analytics can help users track their progress towards financial goals, monitor their financial health, and make adjustments to their budget as needed.