Diving into the world of economic cycles, this intro sets the stage for an insightful journey through the ups and downs of financial trends. Get ready to explore the heartbeat of the economy in a whole new light.

Exploring the phases, factors, and impacts of economic cycles, we uncover the hidden patterns that drive our financial world.

Overview of Economic Cycles

Economic cycles refer to the fluctuations in economic activity over time. These cycles are characterized by periods of expansion, peak, contraction, and trough. Understanding economic cycles is crucial for policymakers, investors, and businesses as it helps in predicting trends and making informed decisions.

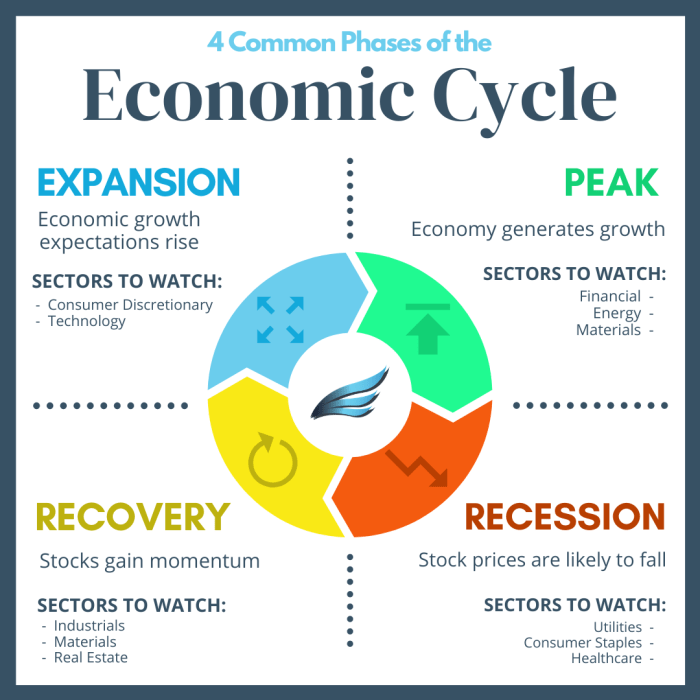

Phases of Economic Cycles

- Expansion: During this phase, the economy grows, and there is an increase in employment, production, and consumer spending. Businesses are optimistic, and investments are on the rise.

- Peak: The peak marks the highest point of economic growth in a cycle. In this phase, inflation may start to rise, and there is a sense of overheating in the economy. It is usually followed by a contraction.

- Contraction: Also known as a recession, this phase involves a decline in economic activity. Unemployment rises, consumer spending decreases, and businesses cut back on investments. It is a period of negative growth.

- Trough: The trough is the lowest point of the cycle, where the economy hits bottom. It is characterized by high unemployment, low consumer confidence, and reduced production. However, it also sets the stage for the next phase of expansion.

Examples of Historical Economic Cycles

- The Great Depression: The economic cycle of the 1930s in the United States is one of the most famous examples of a severe contraction. It lasted for almost a decade and had a profound impact on the global economy.

- The Dot-Com Bubble: In the late 1990s to early 2000s, there was a period of rapid expansion in the technology sector, leading to inflated stock prices. When the bubble burst, it resulted in a significant contraction in the economy.

- The Global Financial Crisis: The 2008 financial crisis was another example of a contraction phase in the economic cycle. It was triggered by the collapse of the housing market and resulted in a severe recession worldwide.

Factors Influencing Economic Cycles

Interest rates, government policies, and consumer spending are key factors that influence economic cycles, shaping the rise and fall of economies.

Role of Interest Rates

Interest rates play a crucial role in economic cycles. When central banks raise interest rates, borrowing becomes more expensive, leading to reduced consumer spending and business investments. This can slow down economic growth and potentially trigger a recession. On the other hand, lowering interest rates can stimulate borrowing and spending, boosting economic activity and helping to pull the economy out of a downturn.

Government Policies Impact

Government policies have a significant impact on economic cycles. Fiscal policies, such as changes in taxation and government spending, can influence consumer behavior and business decisions. For example, during a recession, governments may implement stimulus packages to increase spending and stimulate economic growth. Conversely, during periods of high inflation, policymakers may adopt contractionary measures to cool down the economy.

Influence of Consumer Spending

Consumer spending is a major driver of economic cycles. When consumers feel confident about the economy, they are more likely to spend money on goods and services, boosting demand and driving economic growth. However, during times of uncertainty or economic downturns, consumers may cut back on spending, leading to a decrease in demand and potentially causing a recession.

Indicators of Economic Cycles

Economic cycles can be tracked using key indicators that provide insights into the overall health of the economy. Understanding these indicators is crucial for predicting future economic trends and making informed decisions.

GDP Growth

- Gross Domestic Product (GDP) growth is a vital indicator used to track economic cycles. It measures the total value of all goods and services produced within a country’s borders.

- During an economic expansion phase, GDP growth tends to be positive and robust, indicating a healthy and growing economy. Conversely, during a contraction phase, GDP growth slows down or becomes negative, signaling an economic downturn.

- High GDP growth rates are typically associated with prosperity, increased consumer spending, and business investments, while low or negative growth rates may indicate recession or economic stagnation.

Unemployment Rates

- Unemployment rates are another critical indicator when analyzing economic cycles. They reflect the percentage of the labor force that is actively seeking employment but unable to find work.

- During economic expansions, unemployment rates tend to decline as businesses expand and create more job opportunities. On the other hand, during economic contractions, unemployment rates rise as companies lay off workers to cut costs.

- High unemployment rates can lead to reduced consumer spending, lower demand for goods and services, and overall economic slowdown. Conversely, low unemployment rates can stimulate economic growth by boosting consumer confidence and spending.

Impact of Economic Cycles

In understanding economic cycles, it is crucial to recognize the significant impact they have on businesses, the stock market, and individual finances. These cycles dictate the overall health of the economy and can greatly influence various aspects of our financial lives.

Business Impact

- During economic downturns or recessions, businesses often experience a decrease in consumer spending, leading to lower revenues and potential layoffs.

- Conversely, in periods of economic expansion, businesses may see increased demand for their products or services, resulting in growth opportunities and higher profits.

- Adapting to these fluctuations is essential for businesses to survive and thrive in different economic environments.

Stock Market Implications

- The stock market is highly sensitive to economic cycles, with downturns often causing declines in stock prices and market volatility.

- Investors need to be mindful of economic indicators and trends to make informed decisions about buying, selling, or holding onto investments during different phases of the economic cycle.

- Understanding how economic cycles impact the stock market can help individuals manage risk and optimize their investment portfolios accordingly.

Personal Finance Navigation

- Individuals should adjust their financial strategies based on the current economic cycle, such as saving more during periods of economic growth and being cautious with spending during downturns.

- During economic expansions, individuals may consider investing in assets that have the potential for growth, while in recessions, focusing on preserving capital becomes more critical.

- Having a diversified investment portfolio and maintaining an emergency fund can help individuals weather the ups and downs of economic cycles and achieve long-term financial stability.