Yo, listen up! We’re diving into the world of financial portfolio balancing, where the key to securing that bag lies in finding the perfect balance. Get ready to learn the ins and outs of managing your moolah like a pro.

Now, let’s break it down and explore why balancing your financial portfolio is essential for stacking those coins and securing your financial future.

Importance of Financial Portfolio Balancing

Balancing a financial portfolio is crucial for long-term financial success as it helps in diversifying investments to manage risk and optimize returns. By spreading investments across different asset classes, industries, and regions, investors can reduce the impact of market fluctuations and potential losses.

Risk Management

Maintaining a balanced portfolio helps in mitigating risk by not putting all eggs in one basket. For example, if a portfolio is heavily weighted towards a single stock or sector, any negative news or market downturn in that area can significantly impact the overall value of the portfolio. By diversifying and balancing investments, the risk is spread out, reducing the potential negative impact on the entire portfolio.

Return on Investment

Balancing a portfolio can also lead to better returns over time. Different asset classes perform differently under various market conditions. By having a mix of investments, including stocks, bonds, real estate, and other assets, investors can benefit from the positive performance of some investments even when others may be underperforming. This can help in achieving a more stable and consistent growth in the portfolio.

Negative Impact of Unbalanced Portfolio

An unbalanced portfolio can lead to higher volatility and increased risk exposure. For instance, if a portfolio is heavily skewed towards high-risk assets without any diversification, a market downturn can result in significant losses. Moreover, an unbalanced portfolio may not be aligned with an investor’s financial goals or risk tolerance, leading to suboptimal performance and potential financial setbacks.

Strategies for Financial Portfolio Balancing

In order to effectively balance a financial portfolio, it is crucial to implement various strategies that help manage risk and optimize returns. Some key strategies include asset allocation, diversification, and rebalancing.

Asset Allocation

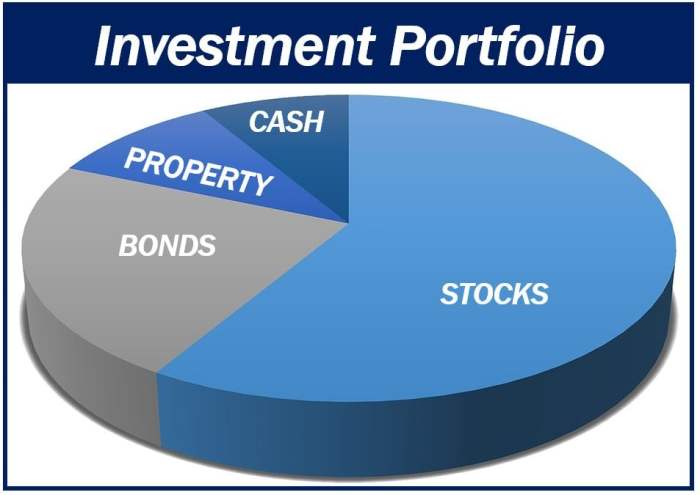

Asset allocation involves dividing your investment portfolio among different asset classes such as stocks, bonds, and cash equivalents. The goal is to create a diversified mix of investments that can help mitigate risk and maximize returns. By spreading your investments across different asset classes, you can reduce the impact of market fluctuations on your overall portfolio.

Diversification

Diversification is a strategy that involves spreading investments within each asset class. This means investing in a variety of securities within a particular asset class to further reduce risk. By diversifying your investments, you can minimize the impact of poor performance from a single security or sector on your overall portfolio.

Rebalancing

Rebalancing involves periodically reviewing and adjusting your portfolio to maintain your desired asset allocation. This strategy ensures that your portfolio stays aligned with your investment goals and risk tolerance. By selling assets that have performed well and buying assets that have underperformed, you can bring your portfolio back to its target allocation.

Risk Tolerance

Risk tolerance is an important factor to consider when balancing a financial portfolio. It refers to your ability and willingness to withstand fluctuations in the value of your investments. Your risk tolerance will influence the asset allocation of your portfolio, as well as the level of diversification you choose to implement. It is essential to align your portfolio with your risk tolerance to ensure you can stay invested during market downturns without making emotional decisions.

Active vs. Passive Portfolio Management

Active portfolio management involves frequent buying and selling of securities in an attempt to outperform the market. This approach requires constant monitoring and analysis of investments. On the other hand, passive portfolio management involves investing in index funds or ETFs to match the performance of a specific market index. Passive management typically has lower fees and can be a more hands-off approach to portfolio balancing. Both strategies have their own advantages and drawbacks, and the choice between them will depend on your investment goals and risk tolerance.

Tools and Techniques for Balancing a Financial Portfolio

In order to effectively balance a financial portfolio, investors can utilize various tools and techniques to analyze and adjust their investments as needed.

Portfolio Analysis Tools

- One popular tool for portfolio analysis is the Modern Portfolio Theory (MPT), which helps investors understand the risks and returns of their investments.

- Asset allocation tools such as Riskalyze or Morningstar can also assist in determining the optimal mix of assets based on the investor’s risk tolerance and investment goals.

- Financial calculators like the Sharpe Ratio or the Sortino Ratio can provide insights into the performance of the portfolio compared to the market or a benchmark.

Portfolio Rebalancing Platforms

- Wealth management platforms like Personal Capital or Betterment offer automated portfolio rebalancing based on the investor’s preferences and financial goals.

- Robo-advisors such as Wealthfront or Wealthsimple use algorithms to rebalance portfolios regularly, taking into account market changes and the investor’s risk profile.

- Online brokerage platforms like TD Ameritrade or E*TRADE provide tools for monitoring and adjusting portfolio allocations, giving investors the flexibility to make changes as needed.

Role of Financial Advisors

- Financial advisors play a crucial role in helping individuals balance their portfolios by providing personalized investment advice based on the client’s financial situation and goals.

- They can offer guidance on asset allocation, risk management, and rebalancing strategies to ensure the portfolio remains aligned with the investor’s objectives.

- Financial advisors can also help clients navigate complex financial decisions, stay informed about market trends, and make adjustments to the portfolio as needed to optimize performance.

Challenges in Financial Portfolio Balancing

When it comes to balancing a financial portfolio, investors often face various challenges that can impact their investment decisions. These challenges can range from market fluctuations to individual risk tolerance levels. It is essential for investors to be aware of these obstacles and develop strategies to overcome them in order to maintain a well-balanced portfolio.

Impact of Market Volatility

Market volatility is a major challenge that investors face when trying to balance their portfolios. Sudden and unpredictable changes in the market can lead to significant fluctuations in the value of investments. This can make it difficult to maintain a balanced portfolio, as the risk levels of different assets may change rapidly.

To overcome the challenges posed by market volatility, investors can consider diversifying their portfolios across different asset classes. By spreading their investments across various sectors, regions, and types of assets, investors can reduce the impact of market fluctuations on their overall portfolio.

Additionally, investors can also implement a disciplined approach to portfolio rebalancing. Regularly reviewing and adjusting the asset allocation of their portfolios can help investors stay on track with their investment goals and maintain a balanced portfolio despite market volatility.