Ready to dive into the world of Financial metrics for startups? Buckle up as we explore why these metrics are the lifeblood of emerging businesses, providing a roadmap to success and growth.

From revenue to growth metrics, we’ll uncover the key factors that drive decision-making and propel startups forward in the competitive landscape of business.

Importance of Financial Metrics for Startups

Financial metrics are crucial for startups as they provide valuable insights into the company’s financial health and performance. By tracking key financial metrics, startups can better understand their revenue, expenses, and overall profitability. This information is essential for making informed decisions, setting realistic goals, and identifying areas for improvement.

Examples of Key Financial Metrics for Startups

- Cash Burn Rate: This metric helps startups understand how quickly they are spending their cash reserves. It is important for managing cash flow and ensuring sustainability.

- Customer Acquisition Cost (CAC): CAC measures how much it costs to acquire a new customer. Startups need to keep this metric low to ensure profitability.

- Monthly Recurring Revenue (MRR): MRR is the predictable revenue that a startup can expect each month. It is crucial for forecasting and growth planning.

- Gross Margin: Gross margin indicates the profitability of each product or service sold. Startups need to monitor this metric to ensure they are pricing their offerings effectively.

How Tracking Financial Metrics Helps Startups Make Informed Decisions

By tracking financial metrics, startups can make informed decisions based on data rather than assumptions. For example, if a startup notices a high customer acquisition cost compared to their average customer lifetime value, they can adjust their marketing strategies to improve efficiency and profitability. Similarly, monitoring cash burn rate can help startups identify areas where they can reduce expenses or increase revenue to extend their runway.

Types of Financial Metrics

Financial metrics are essential for startups to track and analyze their performance. There are different types of financial metrics that provide valuable insights into various aspects of a startup’s financial health. Let’s dive into the different types of financial metrics relevant to startups:

Revenue Metrics

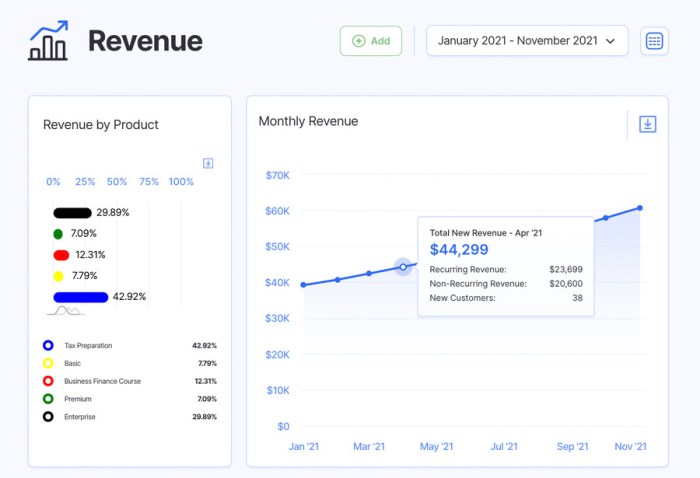

Revenue metrics focus on the income generated by the startup. Examples of revenue metrics include:

- Monthly Recurring Revenue (MRR): The predictable revenue that a company expects to receive every month.

- Customer Lifetime Value (CLV): The total revenue a company expects to earn from a customer throughout their entire relationship.

- Churn Rate: The percentage of customers who stop using a company’s product or service over a specific period.

Profitability Metrics

Profitability metrics measure the startup’s ability to generate profits. Examples of profitability metrics include:

- Gross Profit Margin: The percentage of revenue that exceeds the cost of goods sold.

- Net Profit Margin: The percentage of revenue that remains as profit after all expenses have been deducted.

- Return on Investment (ROI): The ratio of net profit to the initial investment made.

Growth Metrics

Growth metrics focus on the startup’s expansion and scalability. Examples of growth metrics include:

- Customer Acquisition Cost (CAC): The cost associated with acquiring a new customer.

- Monthly Active Users (MAU): The number of unique users who engage with the startup’s product or service in a month.

- Retention Rate: The percentage of customers who continue to use the product or service over time.

Leading Indicators vs. Lagging Indicators

Leading indicators are predictive metrics that signal future trends, while lagging indicators are retrospective metrics that reflect past performance. It is crucial for startups to analyze both types of indicators to get a holistic view of their financial health. For example:

- Leading Indicator: Number of qualified leads can indicate potential future revenue growth.

- Lagging Indicator: Revenue growth rate can show how well the startup has performed in the past.

How to Calculate Financial Metrics

When it comes to startups, crunching numbers is crucial for success. Calculating financial metrics accurately can help you make informed decisions and steer your business in the right direction.

Calculating Gross Margin

To calculate the gross margin, you need to subtract the cost of goods sold (COGS) from total revenue, and then divide the result by total revenue. The formula looks like this:

(Total Revenue – COGS) / Total Revenue

Calculating Burn Rate

To calculate the burn rate, you need to determine the amount of money your startup is spending each month. The formula is simple:

Total Expenses / Number of Months

Calculating Customer Acquisition Cost

Calculating the customer acquisition cost involves dividing your total sales and marketing expenses by the number of customers acquired. The formula is:

Total Sales and Marketing Expenses / Number of Customers Acquired

Significance of Accurate Calculations

Accurate calculations of financial metrics are essential for startups as they provide a clear picture of the company’s financial health. By knowing these numbers, you can identify areas that need improvement, make informed decisions, and set realistic goals for growth.

Interpreting Financial Metrics

When it comes to startups, interpreting financial metrics is crucial for making informed decisions and ensuring the business is on the right track financially. By analyzing these metrics effectively, startups can identify trends, spot potential issues, and make adjustments to improve their financial performance.

Effective Interpretation Strategies

- Compare Metrics Over Time: Track key financial metrics regularly and compare them over different periods to identify patterns and trends.

- Benchmark Against Industry Standards: Compare your financial metrics to industry benchmarks to see how your startup is performing relative to competitors.

- Look for Variances: Analyze any significant variances in the financial metrics and investigate the root causes behind them.

- Consider Context: Understand the context in which the financial metrics are operating, taking into account external factors that may impact the numbers.

Best Practices for Analysis

- Focus on Key Metrics: Rather than getting overwhelmed by numerous metrics, focus on a few key indicators that are most relevant to your startup’s goals.

- Use Visualization Tools: Utilize graphs, charts, and other visualization tools to make it easier to interpret and communicate financial data.

- Seek Expert Advice: Consider consulting with financial experts or mentors to gain valuable insights and perspectives on your financial metrics.

Common Pitfalls to Avoid

- Ignoring Non-Financial Metrics: Don’t overlook non-financial metrics that can provide valuable context and insights into the financial performance of your startup.

- Relying Solely on Historical Data: While historical data is important, don’t forget to incorporate forward-looking indicators and projections into your analysis.

- Overlooking Cash Flow: Cash flow is a critical metric for startups, so make sure to pay close attention to it and its impact on your business operations.