Yo, diving into the world of Index funds explained, where we break down the basics and give you the lowdown on how to make your money work for you. Get ready to level up your investment game!

So, what exactly are index funds and how do they work? Let’s find out in the next section.

What are Index Funds?

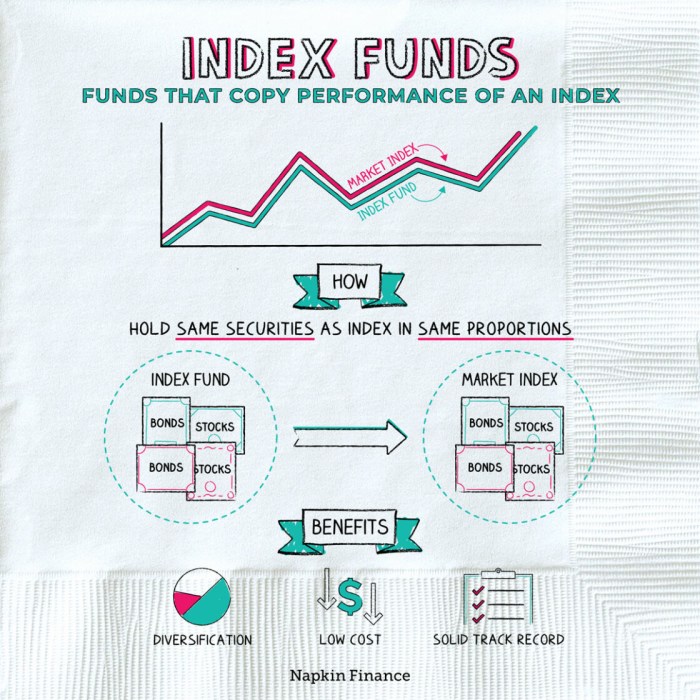

Index funds are a type of mutual fund or exchange-traded fund (ETF) that is designed to track a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. The main purpose of index funds is to provide investors with broad market exposure and diversification at a low cost.

Passive Management

Index funds are passively managed, meaning they are designed to replicate the performance of a specific index rather than actively selecting individual investments. This passive approach typically results in lower fees and expenses compared to actively managed funds.

Popular Index Funds

- Vanguard Total Stock Market Index Fund (VTSAX)

- Schwab S&P 500 Index Fund (SWPPX)

- iShares Core S&P 500 ETF (IVV)

Benefits of Investing in Index Funds

- Low Costs: Index funds generally have lower expenses than actively managed funds, allowing investors to keep more of their returns.

- Diversification: By tracking an entire index, investors are automatically diversified across a wide range of securities, reducing individual stock risk.

- Consistent Performance: Index funds aim to match the performance of the underlying index, providing investors with predictable returns over the long term.

- Efficiency: Since index funds are passively managed, they tend to have lower turnover rates, resulting in fewer taxable events for investors.

How do Index Funds Work?

Index funds work by tracking a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. These funds aim to replicate the performance of the index they are tracking by holding the same stocks in the same proportions.

Diversification within Index Funds

Index funds offer investors instant diversification because they hold a large number of stocks within a single fund. This diversification helps reduce the risk associated with investing in individual stocks, as losses from one stock can be offset by gains in another.

Low-Cost Investment Options

One of the key advantages of index funds is their low cost. Since they passively track an index and do not require active management by a fund manager, they have lower operating expenses compared to actively managed funds. This translates to lower fees for investors, allowing them to keep more of their investment returns.

Role of Index Fund Managers

While index funds are passively managed, index fund managers play an important role in maintaining the fund’s portfolio to accurately reflect the index they are tracking. This involves periodic rebalancing to ensure that the fund’s holdings align with the index’s composition. Additionally, fund managers may make adjustments to account for changes in the index, such as additions or deletions of stocks.

Types of Index Funds

Index funds come in various types, each catering to different investment objectives and risk profiles. Understanding the differences between market index funds, bond index funds, and sector-specific index funds can help investors make informed decisions based on their financial goals.

Market Index Funds

Market index funds track a specific stock market index, such as the S&P 500 or the Dow Jones Industrial Average. These funds provide broad exposure to the overall market and are considered a low-cost way to achieve diversification. Investors looking for long-term growth and exposure to the overall market often opt for market index funds.

Bond Index Funds

Bond index funds, on the other hand, track a specific bond market index, such as the Bloomberg Barclays U.S. Aggregate Bond Index. These funds invest in a portfolio of bonds that mirror the index, providing investors with exposure to fixed-income securities. Bond index funds are generally considered less risky than stock index funds, making them suitable for conservative investors seeking income and capital preservation.

Sector-Specific Index Funds

Sector-specific index funds focus on a particular sector of the market, such as technology, healthcare, or energy. These funds offer targeted exposure to a specific industry or sector, allowing investors to capitalize on the potential growth of that sector. However, sector-specific index funds are more concentrated and therefore carry higher risk compared to market index funds.

Investors should consider their risk tolerance, investment timeframe, and financial goals when choosing index funds. Diversifying across different types of index funds can help mitigate risk and optimize portfolio performance. It’s essential to conduct thorough research and seek professional advice if needed to select the most suitable index funds aligned with individual financial objectives.

Index Funds vs. Mutual Funds

When comparing index funds and mutual funds, it’s essential to understand the key differences in management style, costs, performance, and tax efficiency.

Management Style

Index funds are passively managed, meaning they aim to replicate the performance of a specific index, such as the S&P 500, by holding the same securities in the same proportions. On the other hand, mutual funds are actively managed, with fund managers making investment decisions to outperform the market.

Costs Comparison

Index funds typically have lower expense ratios compared to actively managed mutual funds. Since index funds follow a passive investment strategy, there is less frequent buying and selling of securities, leading to lower transaction costs. Mutual funds, on the other hand, involve higher management fees and trading costs due to active management.

Performance Differences

Over the long term, index funds tend to outperform actively managed mutual funds, mainly due to lower costs. Research has shown that only a small percentage of actively managed funds consistently beat the market after accounting for fees. Index funds provide broad market exposure and benefit from the overall market growth.

Tax Efficiency

Index funds are known for their tax efficiency compared to mutual funds. Since index funds have lower turnover rates and fewer capital gains distributions, investors may face lower tax liabilities. Actively managed mutual funds may trigger capital gains taxes when fund managers buy and sell securities within the fund.