Diving into the world of Mutual funds vs. ETFs, get ready for an epic showdown between these two investment giants. From key differences to investment strategies, this comparison will have you on the edge of your seat, eager to uncover which option reigns supreme in the financial arena.

As we navigate through the intricate details of mutual funds and ETFs, brace yourself for a rollercoaster ride of information that will leave you informed and empowered to make the best investment decisions for your future.

Key Differences

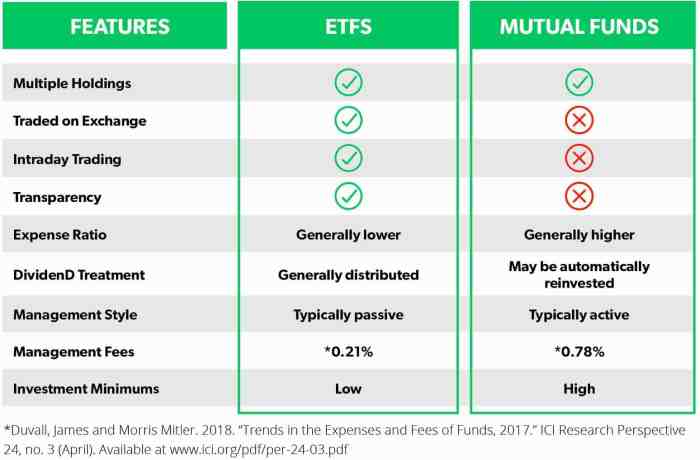

When it comes to mutual funds and ETFs, there are some key differences that investors should be aware of. Let’s break down the fundamental distinctions between these two types of investments.

Unique Features

- Mutual Funds: Mutual funds are actively managed by professional fund managers who make decisions on what to buy and sell within the fund. This can lead to higher fees compared to ETFs.

- ETFs: ETFs are passively managed and typically track a specific index or sector. They often have lower expense ratios compared to mutual funds.

Liquidity

- Mutual Funds: Mutual funds are only priced and traded at the end of the trading day. Investors buy and sell mutual fund shares directly from the fund company.

- ETFs: ETFs are traded on the stock exchange throughout the trading day, allowing investors to buy and sell shares at market price whenever the market is open.

Tax Efficiency

- Mutual Funds: Mutual funds can be less tax-efficient compared to ETFs due to their structure. Mutual funds may distribute capital gains to shareholders, leading to tax consequences for investors.

- ETFs: ETFs are generally more tax-efficient because of their unique structure. ETFs typically have lower capital gains distributions, reducing the tax burden on investors.

Investment Strategies

When it comes to investment strategies, mutual funds and ETFs each have their own unique approaches to help investors grow their money. Let’s dive into the details of how these two types of investments differ in their strategies.

Mutual Funds Investment Strategies

Mutual funds are typically actively managed by a team of investment professionals who make decisions on which assets to buy or sell within the fund. These managers analyze market trends, company performance, and other factors to try and outperform the market. Some common investment strategies used in mutual funds include:

- Growth Investing: Focusing on companies with high growth potential

- Value Investing: Looking for undervalued stocks with potential for growth

- Income Investing: Prioritizing investments that provide regular income

ETFs Investment Strategies

ETFs, on the other hand, typically follow a passive investment approach. Instead of actively managed, ETFs often track a specific index or asset class. This means that the fund aims to replicate the performance of the index it’s tracking, rather than trying to beat the market. Some common investment strategies implemented by ETFs include:

- Index Tracking: Mirroring the performance of a specific index like the S&P 500

- Sector Investing: Focusing on specific sectors like technology or healthcare

- Dividend Investing: Targeting high-dividend-paying stocks for income

It’s important for investors to understand the different investment strategies employed by mutual funds and ETFs to align with their financial goals and risk tolerance.

Cost Structures

When it comes to investing in mutual funds and ETFs, understanding the cost structures is crucial for maximizing long-term investment returns. Let’s dive into the comparison of expense ratios, additional fees, and the impact they have on your investments.

Expense Ratios Comparison

Expense ratios play a significant role in determining the overall cost of investing in mutual funds and ETFs. Mutual funds typically have higher expense ratios compared to ETFs, as they involve more active management and research by fund managers. On the other hand, ETFs are passively managed, leading to lower expense ratios.

Additional Fees in Mutual Funds

In addition to expense ratios, mutual funds may come with additional fees such as sales loads, redemption fees, and management fees. Sales loads are commissions paid to brokers when buying or selling mutual fund shares, while redemption fees are charged when selling shares within a specific time frame. These fees can eat into your investment returns over time.

Impact of Expense Ratios on Returns

The impact of expense ratios on long-term investment returns cannot be underestimated. Even a seemingly small difference in expense ratios can have a significant effect on your overall returns over time. Lower expense ratios in ETFs can result in higher net returns for investors compared to mutual funds with higher expense ratios.

Differences in Cost Structures

Overall, the cost structures of mutual funds and ETFs differ mainly in expense ratios and additional fees. While mutual funds may offer active management and research at a higher cost, ETFs provide a more cost-effective option for passive investors looking to minimize expenses and maximize returns in the long run.

Market Trading

When it comes to market trading, both mutual funds and ETFs have their own unique mechanisms that impact how they are bought and sold.

Trading Mechanism for Mutual Funds

Mutual funds are traded at the end of the trading day at the net asset value (NAV) price. Investors can place orders throughout the day, but they will only receive the NAV price at the close of the market.

Contrast with ETFs

Unlike mutual funds, ETFs are traded on an exchange throughout the trading day. This means that the price of an ETF can fluctuate based on supply and demand, similar to individual stocks.

Impact of Market Volatility

Market volatility can affect mutual funds and ETFs differently due to their trading mechanisms. Mutual funds may be more insulated from intraday price fluctuations, while ETFs can experience more immediate impacts from market volatility.

Market Conditions on Trading

During times of high market volatility, mutual funds may see more redemptions as investors react to the market conditions. ETFs, on the other hand, may see increased trading volume as investors seek to capitalize on price movements.