Diving into the realm of 401(k) withdrawal penalties opens up a world of financial consequences that can impact your retirement savings. From early withdrawal penalties to strategies for minimizing the impact, this guide will provide a comprehensive overview to help you navigate the complexities of 401(k) withdrawals.

Overview of 401(k) Withdrawal Penalties

When it comes to 401(k) withdrawal penalties, it’s important to understand the consequences of taking out money from your retirement account before the designated age. Early withdrawals can result in hefty penalties and impact your long-term savings goals.

Common Penalties Associated with Early Withdrawals

- Early Withdrawal Penalty: Typically, if you withdraw funds before the age of 59 ½, you may face an early withdrawal penalty of 10% on top of regular income tax.

- Income Tax Consequences: Any amount withdrawn from a traditional 401(k) is subject to income tax, which can further reduce your savings.

- Loss of Compounding Growth: Taking out money early means missing out on potential compounding growth, which can significantly impact the overall value of your retirement account.

Types of 401(k) Withdrawal Penalties

When it comes to withdrawing from a 401(k) account, there are different penalties that individuals need to be aware of. These penalties can vary depending on whether the withdrawal is made before or after retirement age.

Early Withdrawal Penalties

- For individuals under 59 ½ years old, withdrawing from a 401(k) account typically incurs a 10% early withdrawal penalty on top of the regular income tax due.

- Early withdrawals are also subject to income tax, which means that individuals may end up paying a significant amount in taxes and penalties.

- Exceptions to the early withdrawal penalty include using the funds for certain qualified expenses such as medical bills, higher education costs, or first-time home purchases.

Penalties After Retirement Age

- Once an individual reaches 59 ½ years old, they can start making withdrawals from their 401(k) without incurring the 10% early withdrawal penalty.

- However, withdrawals made after retirement age are still subject to income tax, as the funds were contributed on a pre-tax basis.

- Individuals are required to start taking minimum distributions from their 401(k) once they reach 72 years old to avoid penalties for not withdrawing the required amount.

Calculating 401(k) Withdrawal Penalties

When it comes to calculating 401(k) withdrawal penalties, it’s essential to understand the process and factors involved. Penalties are incurred when you withdraw funds from your 401(k) account before reaching the age of 59 ½, with certain exceptions.

How Penalties are Calculated

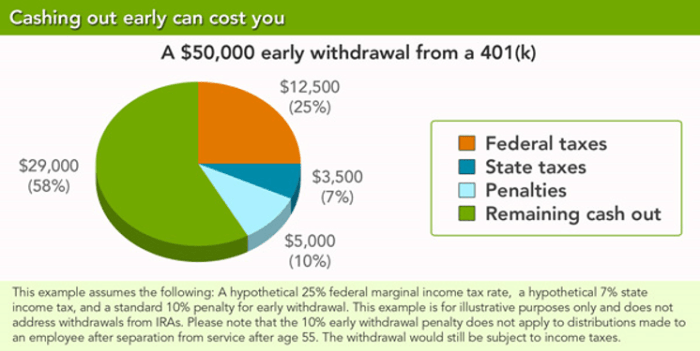

- Early Withdrawal Penalty Formula: The early withdrawal penalty is typically 10% of the amount withdrawn before the age of 59 ½. This penalty is in addition to any income tax owed on the withdrawal.

- Example: If you withdraw $10,000 from your 401(k) before the age of 59 ½, you would incur a penalty of $1,000 (10% of $10,000).

Factors Influencing Penalty Calculation

- Age: The age at which you make the withdrawal is a crucial factor. If you are under 59 ½, you are likely to face penalties.

- Reason for Withdrawal: Certain exceptions, such as disability or specific financial hardships, may waive the penalty.

- Income Tax Bracket: The amount withdrawn is also subject to income tax, which can further impact the overall penalty amount.

Strategies to Minimize 401(k) Withdrawal Penalties

When it comes to withdrawing from your 401(k) account, it’s important to consider strategies that can help minimize penalties and maximize your savings. By being strategic and informed, you can avoid unnecessary fees and charges that may eat into your retirement funds.

Rollover Options for Penalty Mitigation

One effective strategy to minimize 401(k) withdrawal penalties is to consider a rollover. By rolling over your 401(k) funds into another qualified retirement account, such as an IRA, you can avoid immediate penalties and continue to grow your savings tax-deferred. This option allows you to maintain the benefits of your retirement savings without incurring unnecessary fees.

Financial Planning Tactics for Penalty Reduction

– Consider setting up an emergency fund: By having a separate fund for unexpected expenses, you can avoid dipping into your 401(k) and triggering penalties.

– Plan your withdrawals strategically: If you need to make a withdrawal, try to space them out over time to minimize the impact of penalties.

– Explore loan options: Some 401(k) plans allow for loans, which can be a way to access funds without incurring penalties, as long as you repay the loan on time.

– Consult with a financial advisor: Seeking professional advice can help you navigate the complexities of 401(k) withdrawals and develop a personalized strategy to minimize penalties.