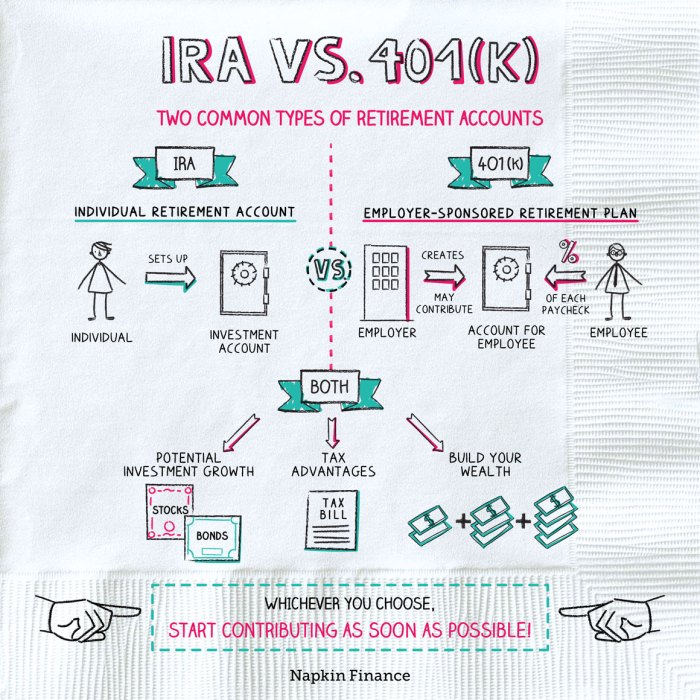

When it comes to planning for retirement, the choice between a 401(k) and an IRA can be a crucial decision that impacts your financial future. Let’s dive into the details of these two popular retirement accounts to help you make an informed choice that suits your needs.

In the world of retirement planning, understanding the nuances of a 401(k) versus an IRA can make all the difference in securing a comfortable future.

Overview of 401(k) and IRA

401(k) retirement account is a type of employer-sponsored retirement plan where employees can contribute a portion of their paycheck on a pre-tax basis. The contributions are invested in a variety of options like stocks, bonds, and mutual funds, allowing the account to grow over time. The main purpose of a 401(k) is to help individuals save for retirement and take advantage of potential employer matching contributions.

Individual Retirement Account (IRA) is a personal retirement account that individuals can open on their own. Contributions to an IRA are typically made with after-tax dollars, and the account offers a range of investment options similar to a 401(k). The primary goal of an IRA is to provide individuals with a tax-advantaged way to save for retirement.

Eligibility Criteria

- 401(k): Eligibility for a 401(k) plan is usually determined by the employer, with many companies offering it to full-time employees after a certain period of employment. Some employers may also require a minimum age or hours worked per week to participate.

- IRA: Any individual with earned income can open an IRA, regardless of employer-sponsored retirement plans. However, there are income limits for contributing to a Roth IRA, and tax deductibility of contributions to a Traditional IRA may be subject to income restrictions.

Contribution Limits and Matching

When it comes to saving for retirement, understanding contribution limits and matching for 401(k) and IRA accounts is crucial. Let’s dive into the details below.

Contribution Limits

- 401(k): In 2021, the contribution limit for a 401(k) account is $19,500 for individuals under 50 years old. If you are 50 or older, you can make additional catch-up contributions of up to $6,500, bringing the total limit to $26,000.

- IRA: For traditional and Roth IRAs, the contribution limit in 2021 is $6,000 for individuals under 50. Those 50 and older can contribute an extra $1,000 as a catch-up contribution, making the total limit $7,000.

Employer Matching in 401(k)

- Employer matching in a 401(k) account is like free money for your retirement savings. Many employers offer to match a percentage of your contributions, typically up to a certain limit. For example, a common match is 50% of your contributions up to 6% of your salary. If you contribute 6% of your salary, your employer will match half of that amount, effectively giving you an additional 3% of your salary in retirement savings.

- It’s important to take advantage of employer matching if it’s offered, as it can significantly boost your retirement savings over time.

Contribution Flexibility

- 401(k): Contributions to a 401(k) account are typically deducted directly from your paycheck, making it a convenient and automatic way to save. However, the contribution limits are set by the IRS and can be restrictive for high-income earners.

- IRA: With an IRA, you have more flexibility in terms of where you can open an account and how much you can contribute. You can choose from a wide range of investment options, but the contribution limits are lower compared to a 401(k).

Tax Implications

When it comes to retirement savings, understanding the tax implications of contributing to a 401(k) or an IRA is crucial. Let’s delve into the tax advantages of each account and compare the tax implications of withdrawals.

401(k) Tax Advantages

Contributing to a 401(k) account offers significant tax advantages. The money you contribute to your 401(k) is typically tax-deductible, meaning it reduces your taxable income for the year. This lowers your current tax bill, allowing you to save more for retirement while enjoying immediate tax benefits. Additionally, the contributions grow tax-deferred, meaning you won’t pay taxes on the gains until you make withdrawals during retirement.

IRA Tax Advantages

Similarly, contributing to an IRA comes with tax advantages. Depending on the type of IRA you have, your contributions may be tax-deductible, reducing your taxable income in the year you make the contributions. This can lead to immediate tax savings. Like a 401(k), the funds in an IRA grow tax-deferred, allowing your investments to compound without being taxed annually. This can help your retirement savings grow more quickly over time.

Withdrawal Tax Implications

When it comes to withdrawing funds from your retirement accounts, there are differences in tax implications between a 401(k) and an IRA. Withdrawals from a traditional 401(k) are taxed as ordinary income, meaning you’ll pay taxes at your regular income tax rate on the amount you withdraw. On the other hand, withdrawals from a traditional IRA are also taxed as ordinary income. However, if you have a Roth IRA, qualified withdrawals in retirement are tax-free, providing a significant tax advantage.

Investment Options and Flexibility

When it comes to investing for your retirement, both 401(k) and IRA offer various options and flexibility to help you grow your savings over time.

Investment Options in 401(k) Account

- Most 401(k) plans offer a selection of mutual funds, stocks, bonds, and target-date funds for investment.

- Some plans may also provide access to exchange-traded funds (ETFs) and company stock.

- Investors can choose their desired allocation based on risk tolerance and investment goals.

Investment Choices and Flexibility in IRA

- IRAs typically offer a wider range of investment options compared to 401(k) plans.

- Investors can invest in individual stocks, bonds, mutual funds, ETFs, real estate, and even precious metals.

- Self-directed IRAs provide the most flexibility, allowing investments in alternative assets like private equity and cryptocurrencies.

Comparison of Control and Diversity

- 401(k) plans offer limited investment options selected by the employer or plan provider, reducing individual control.

- IRAs, especially self-directed IRAs, give investors more control to choose from a broader range of investments, enhancing diversity.

- Overall, IRAs tend to provide greater flexibility and control over investment choices compared to 401(k) accounts.